Funding For Merchants

Cash-flow is the lifeblood of any small business, but especially important for merchants and shopkeepers. Having stocked shelves, effective marketing efforts, paying your employees, having sufficient inventory, and having quality equipment is essential to making sure your business operations run smoothly. But having good cash-flow isn’t enough if your expenses increased faster than your revenue for any period of time. While a small business owner can do their best to forecast how sales will be in the coming weeks, months and years ahead, rarely do business plans go 100% according to plan. As is always the case in business, there are times when sales may dip for whatever reason, or an unexpected business expense arises. When those occurrences happen, it’s important that a merchant or shopkeeper have access to funding to help them cover expenses or to obtain merchant funding to help the business grow. There are many thousands of merchant funding lenders willing to provide financing to just about any type of business, regardless of the situations. In this article, we will focus on the most common merchant funding options available to existing small businesses.

Merchant Funding Uses

- Expansion: Funding used by merchants with the goal of increasing sales week-by-week, month-by-month, until they become very profitable, and are able to expand their operations, and even open up new locations.

- Advertising: Funding used to help the merchant market their goods and services to new customers. Without effective advertising and marketing, a merchant will find itself unable to effectively reach new customers.

- Emergency Funding: Something every business owner can expect at some point is for some unexpected event will leave the merchant in need of obtaining funding to help resolve the issue. Having access to emergency merchant funds may be the difference between major headaches for the business, and smooth operations.

- Payroll Funding: Making sure you have proper funding to make sure your employees are paid on time is something that a business absolutely cannot go without. With merchant payroll funding a business can obtain funding in the matter of days if not hours.

- Inventory Funding: Merchants are in the businesses of reselling goods that they buy wholesale and mark-up to the consumer. If you don’t have the necessary inventory to sell to customers, you won’t find yourself in business very long. With quality merchant inventory financing you’ll be able to have all the goods you need to keep customers satisfied.

Types of Merchant Funding

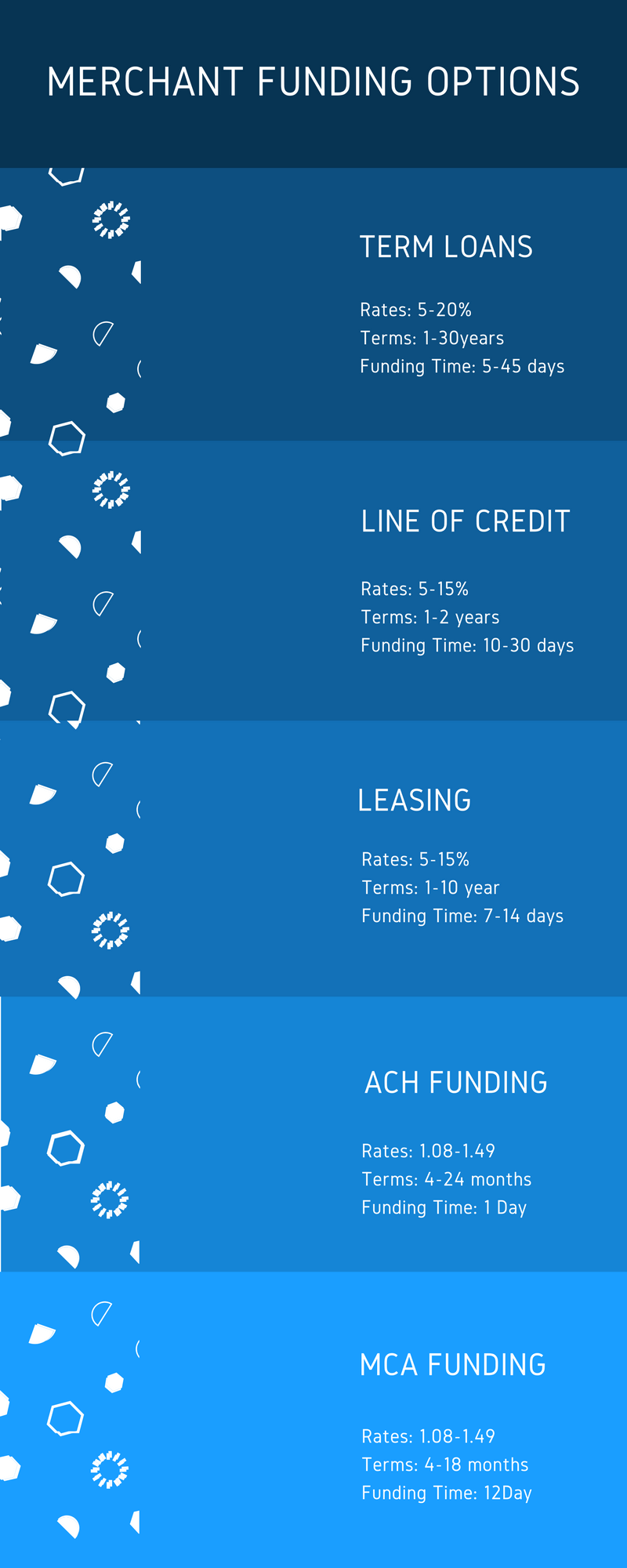

- Bank Funding: Conventional and traditional bank merchant funding is the top options for merchants seeking the most affordable interest rates available. Bank-rates usually start in the mid-single digits, and also have terms that are longer than alternative lenders. Where an alternative lender may have rates that last only a few years or even just months, bank merchant funders have terms that can range between 5-10 years for general business uses, as well as terms ranging between 10-30 years for a commercial real estate mortgage. The downside with bank merchant funding is that conventional business lenders require lots of business and financial documentation, and will need to see that the business is quite profitable. Even more, a conventional merchant funder will require the merchant to have top-grade credit. The process of getting a bank loan can take a rather long time, with some merchant loans taking as long as two months to complete. But, if you are able to complete the conventional loan process, it will be worth it because you will have the healthiest type of business financing available to merchants.

- SBA Funding: Another preferred form of financing for merchants looking for bank-rate financing – SBA financing is a conventional loan offered by banks, credit unions and community banks. The difference between SBA funding an other forms of traditional business funding is the fact that SBA loans come with a special enhancement by the US government that greatly reduces the SBA funders risk involved in the lending process. With SBA merchant funding, the Small Business Administration doesn’t actually lend money to the merchants, but encourages banks and community lenders to provide funding to the merchants by agreeing to cover most of the SBA funders losses should the merchant fail to completely repay the loan.

- Equipment Leasing: While shopkeepers and smaller merchants generally don’t rely on massive heavy equipment and machinery, they do rely on basic equipment like refrigerators, stoves, computers, cash registers, freezers, HVAC units, etc. Sometimes a merchant needs such equipment to help keep their business running smoothly but don’t have the necessary funds to purchase the merchant’s equipment outright. One way for the merchant to get the equipment they need to keep business running is not to take a loan, but instead lease the equipment instead. By leasing the equipment, the merchant can avoid paying for full-cost outright, and won’t be stuck with outdated equipment in the years ahead, as the equipment can simply be returned at the end of the lease term.

- Asset Based Funding: For merchants with sporadic cash-flow that leaves them unable to obtain funding through more conventional and even alternative means, a way to increase your chances of obtaining funding (and larger funding amounts) is to use your business or personal property as collateral to obtain short-term working capital. With asset based merchant funding a merchant can use their real estate or land as collateral, and obtain funding up to 80% of the properties value. Asset based business funding is not only used for working capital, but is also used to refinance and consolidate merchant cash advances.

- Fintech & Alternative Funding: One of the newer types of business financing, alternative fintech merchant funding is a way for small business owners to get a loan with good rates and decent terms, without all the hassles that would be required with getting funded from a bank lender. Alternative funding for merchants takes only a few hours to get approved, and can be funded in a week or less if the merchant is able to provide the required documentation in a timely manner.

- ACH Merchant Funding: a very common form of fast business funding for merchants, an ACH loan is the sale of the merchant’s future revenue, where a funding company will purchase future receivables at a discount and pays the merchant for those receivables weeks and months in advance. What distinguishes ACH funding from a MCA split is that the ACH funder is repaid by collecting a set fee each day directly from the merchant’s bank accounts using Automated Clearing House.

- MCA Funding: As mentioned above, with an ACH loan the funder is repaid using Automated Clearing House. With MCA split funding, the merchant cash advance providers are paid-much a little differently. With MCA funding, the repayments are made by splitting each day’s credit card sales with the funder as repayment. With an ACH there is a set daily payment, but with an MCA split fund a percentage of each day’s sales are remitted to the funder, therefore there is no set amount paid each day.

Conclusion

As you can see there are plenty of small business funding options for merchants. The key is making sure that your business get the right type of financing to meet its need. Ideally, a merchant should want to obtain funding that is tailored to what their business needs. With so many lenders that fund merchants with so many different products, you may find yourself looking for assistance with helping to navigate the process. If you need help obtain the right funding, please contact one of our funding specialist, and we’ll walk you through the process.