Fast Business Loans With Bad Credit

When your business finds itself having an immediate expense that needs financing, you can’t go through the long processes that banks, credit unions and community lenders require. If you have bad or poor credit history, those lenders won’t provide financing to your small business anyway. In fact, if you have bad or poor credit, the options available greatly shrink, as many alternative lenders, fintech lenders and marketplace lender require credit scores of business owners to be at least 670 or above to make it past their preapproval requirements. And that’s before cash-flow analysis and other factors are completed by underwriting during the loan due diligence process. Fact is, if you have bad credit the number of options aren’t plentiful – but that doesn’t mean there aren’t any options at all. In fact, with the rise of new types of alternative lenders the number of bad credit working capital loan options are growing. What’s nice about bad credit business loans, is they can be approved fast, and funding can be completed very quickly. Many times, a bad credit business loan can be funded in as little as 2-3 days. Some poor credit business lenders are even able to fund as fast as the same day. In this article, we will look at the conditions that create bad credit, as well as the fast bad credit business loan options available.

Reasons for Bad Credit

- Late payments: When you pay your small business’s bill late (particularly credit cards and business loans) it will affect your business’s credit. Making sure your bills and debt are paid on-time, on-schedule, always, is important to make sure your business doesn’t end up with bad credit. If you are constantly late making your debt payments, you’re bound to end up with bad credit, as around one-third of your credit score relates to payment history.

- Defaulting on payments: Defaulting on your business’s payments – especially if you’re defaulting on small business loans or other types of debt – can destroy a small business’s credit score. When you default on your debt payment, it is a major red flag to future lenders, as they look to your past payment history before extending credit.

- Charge-off: When a lender sees that a small business has a history of charge offs, the chances of getting some sort of small business financing are extremely slim. Charge-offs generally happen when the small business fails to make payments for 6 months, at which time the lenders will assume that payment will not be made. Having a charge-off is a sure way to affect your credit negatively, so you must avoid charge-offs if you’re trying to avoid having poor credit.

- Collection Accounts: When a small business fails to repay debt for an extended period of time, the lender holding the business debt may sell the loan debt to a third party collections agency. If a third party buys that debt, it may be reported as being rated as “in collections” on the business’s credit report, which will greatly hurt the company’s credit score – which can then sit on your business’s credit report for up to seven years.

- Bankruptcy: When a small business can no longer fulfill their deb and other payments owed, they can file for bankruptcy, which will alleviate their debt problems, and work-out a payment plan for the lenders to be repaid. Oftentimes, the lenders will only be repaid a fraction of the money owed. When you file for bankruptcy, it’s a surefire way to end up with bad credit.

- Foreclosure: If a lender is not repaid after many attempts to recover their money, they may initiate a legal process to help recover their funds by seizing the business or business owner’s personal real estate or other property. If a small business or the company’s owner has had property foreclosed on in the past, it will definitely hurt the company’s credit score.

- Judgements: When a court rules against a small business or a small business owner in a legal proceeding, it may be reported on your credit report as a judgment. So in effect, a civil judgment is a ruling against you in court, generally relating to a lost lawsuit filed against you. When a civil judgment is ruled against you, if will generally affect your credit history negatively.

Reasons for Fast Financing

- Emergencies: Without fail, a business will find itself with some sort of emergency financing needs at some point in time. Waiting weeks or months to address these expenses are not an option, which leads to the need for fast financing.

- Repairs: If you’re business is relient on machinery or equipment that is used for business operations fails on you, its generally going to cost a good chunk of money to fix or replace that equipment. Such vital equipment can not wait for weeks to be addressed, thus: the need for fast business funding.

- Payroll: paying your small business’s employees on time is not negotiable. Your employees are relying on you to pay them on-time, as they’ve planned their own financial expenses around it. If you need to make payroll and don’t have enough money to cover the expenses, getting a fast business loan is essential to making sure your workforce is paid.

- Rent: your lease or mortgage must be paid on time, as going without payment puts your company at risk of losing its workspace. When you find yourself without enough money in your company’s bank accounts to cover your lease or mortgage payments, you may need to get your business funded fast, even with bad credit.

- Taxes: paying your taxes on-time is essential to making sure you don’t end up with the IRS placing a tax lien on your small business. Or, maybe you already have a tax lien on your company, and need fast financing to make your prearranged payment. Getting a fast business loan to pay taxes may be essential to preventing your bank accounts from being levied.

Fast Bad Credit Small Business Loan Types

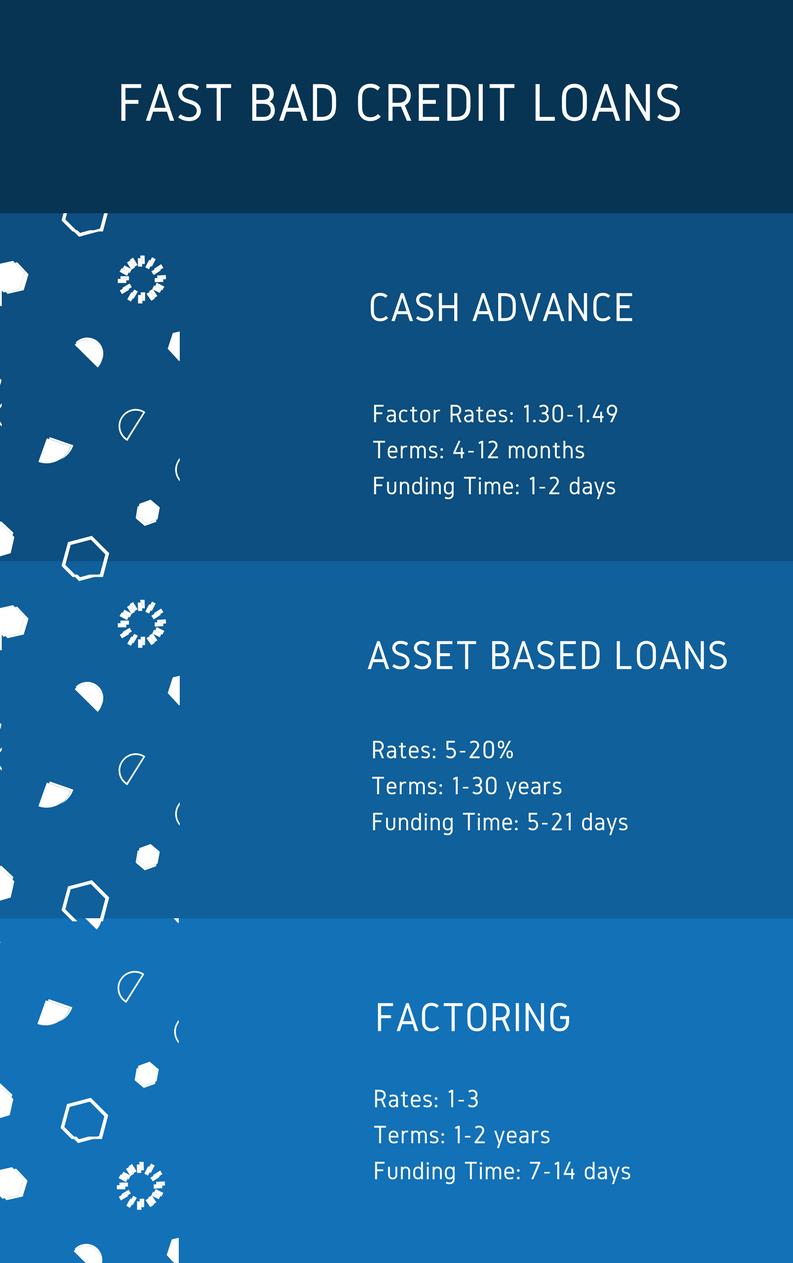

- Cash advance: A merchant cash advance for bad credit are a great way for small businesses or business owners with bad credit to get financing fast because bad credit cash advance lenders don’t focus much on credit but instead focus on the business’s cash flow when deciding whether to provide financing. Since cash advance funders put so much weight behind cash-flow, you can get funded with credit scores of 500 (sometimes even lower).

- Asset based loans: If you’re business has bad credit but needs financing, getting a hard money loan against real estate, or by collateralizing commercial real estate, commercial land, or personal land, is a way to get fast financing with bad credit.

- Factoring: if you have bad credit, but your business has unpaid invoices from other businesses, you may be able to use those invoices as collateral for financing, or even sell those invoices to a factoring company at a discount in exchange for immediate financing.

Conclusion

Ideally you want to have a good credit score so your business can obtain the cheapest financing available (like term loans and lines of credit from banks, SBA lenders, community lenders, credit unions, non-profit lenders, private lenders, etc). So if you have bad credit right now, your main goal should be to do everything possible to help repair your credit so you’ll eventually end up with access to healthy financing options for your small business. In the meantime while working on repairing your credit, its important to understand there are fast business loan options for bad credit. But you need to look in the right places, and shop around for the best rates. If you have bad credit and need a fast business loan, feel free to reach-out to one of our experts, and they will help you navigate the fast business loan with bad credit process.