Business Loans Without a Credit Check

Getting a small business loan in the past usually meant that you had to go to your local bank, start the application process, and supply lots of business documentation, business financials, personal financial information (even the personal financial information of your spouse) along with allowing the financial institution or small business lender to run a credit check on you and your business. If a company had insufficient or poor credit, oftentimes that would immediately cause the small business lender to decline financing. Fact is, credit is used as a gauge by lender’s used for financing, because your personal or business credit reflects your past history of repaying personal or business debt. If you’ve failed to repay other lenders, vendors or creditors, chances are it is reflected on your credit report, thus: reducing your chances of getting approved for financing from a conventional small business lender. So having good credit is crucial if you’re hoping to get approved from a traditional business lender.

Now, whether you have good credit or bad credit, you may find yourself wanting to explore your small business lending options without having any of the prospective lenders pull your credit during the process. In this article we will look at the options available for small businesses looking for funding that want to see their options without having their business or personal credit pulled.

Reasons For Not Wanting Credit Check?

- Too many pulls: When a lender or other potential creditor pulls your credit, it may cause a slight hit to your personal or business credit. Increasing the number of times your credit is pulled will have a negative impact on your overall credit score. Even more, when a small business lender pulls your credit, the inquiry is usually listed on your credit report. When other lenders see that multiple lenders have pulled your credit, it very well may scare them off, as they may feel that you are shopping around (which means they may spend lots of time underwriting a loan, only for you to choose to go with another lender), or may be concerned that you are looking to fund multiple loans at the same time, effectively stacking loans together – which will greatly affect your ability to pay back the lenders.

- Bad Credit: Just because you have a small business with a poor credit history doesn’t mean that you will no longer needs funds for your company. Fact is, small business owners with bad credit often need financing for their operations as much or more than any other business. In the past, if your company has bad credit you were virtually locked-out of financing for your business. But over the past decade since the recession (when bank lenders stopped lending for an extended period of time) alternative lenders were able to create new business lending products that focused less on personal or business credit, and focus more on the company’s cash-flow. With these new bad credit business lenders providing small financing amounts to companies with bad credit, even small businesses with the worst history of paying their debts are able to get funded now.

- Just Exploring Options: Maybe you aren’t ready to fully-commit to the business lending process and just want to look at the business loan options available to your business so your company can debate whether the cost of money of worth it, it may be worth it to seek your financing options without having your credit pulled. If you work with good lenders or quality business loan brokers, they can submit your financials to underwriting without having credit pulled, and are then able to present to the borrower a full-range of offers, providing both the rates and rates & terms.

Types of Business Loans That Don’t Require a Credit Check:

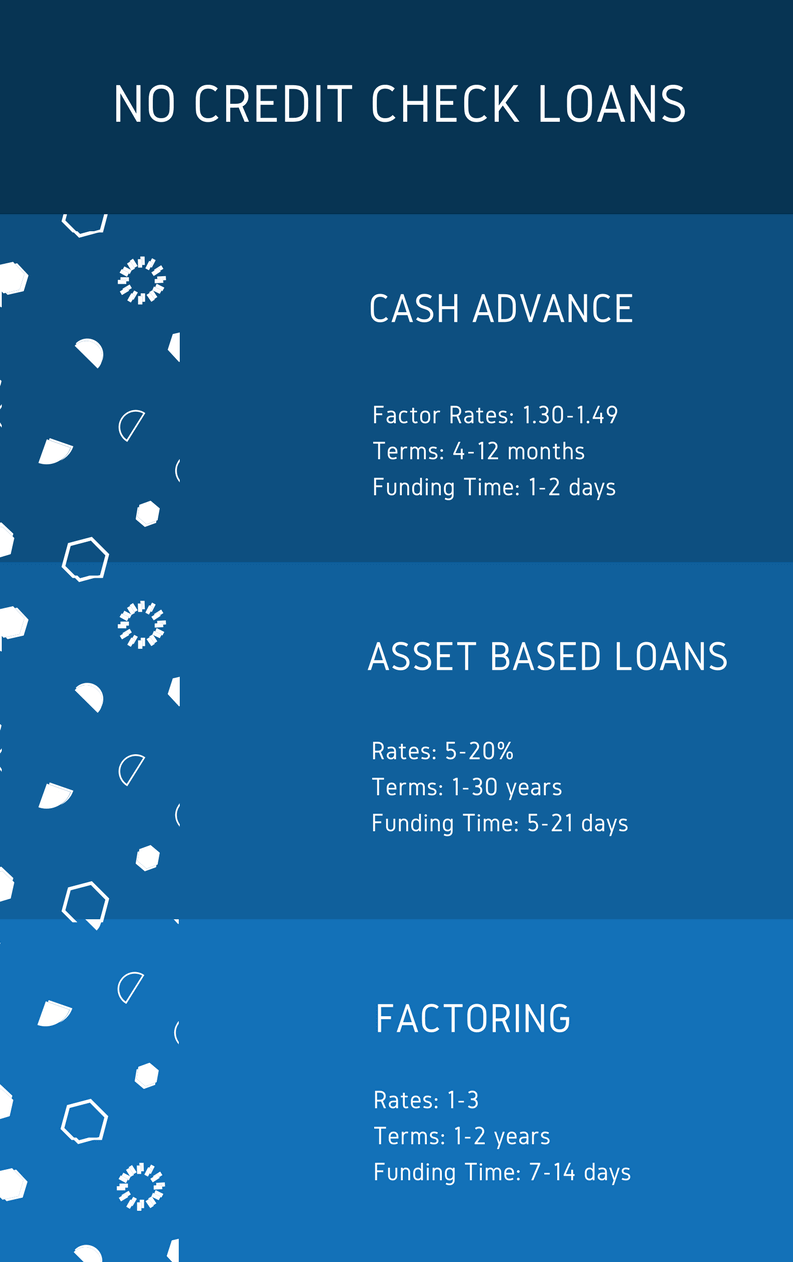

- Invoice Factoring: using your unpaid invoices to obtain financing is a great way for business owners with bad credit to obtain quick financing without having to have their credit pulled. Invoice factoring companies will lend money to a small business by using the unpaid 30 to 90 day invoice as collateral. Since the invoice is being used as the basis for financing, and since the invoice comes from another company than your own, there’s no need to pull your small business’s credit. Once the invoice is supplied to the lender, they will then forward your small business a large percentage of the invoice’s amount and then charge a small fee for the transaction. After the invoice has been fully-paid, the factoring company will then forward the remaining amount to the small business.

- MCA Credit Card Split: Unlike a true lending product, a credit card cash advance is a way to obtain quick business financing without having to rely on credit for approval. As opposed to being credit-driven, a MCA split uses your daily merchant credit card processing account’s transactions as the basis for financing. A cash advance lender will look at how much the small business processes each month in credit card sales, lend the small business an amount of money the lender feels comfortable with, and then collects repayment by splitting each day’s credit card sales with the merchant.

Types of Business Loans That Don’t Need Credit Check For Preapproval:

- SBA Loans: While every SBA lender will eventually require credit be run, they are often able to prequalify a borrower based solely on the company’s financials. The most important part of qualifying for a SBA loan is showing that you have a debt service coverage ratio of 1.1 or more. What that means is that you can show you have the ability to repay the new debt when you include all previous debt obligations.

- Asset Based Loans: Another good option for borrowers that don’t want their credit run during a preapproval process is to seek an asset based loan. If your company has assets (commercial real estate, accounts receivable, inventory, machinery and equipment) and are seeking working capital solutions to help with cash-flow, using your assets could be a good option. And since the loan is fully-collateralized with the assets, the lender’s risk is much reduced than unsecured lenders.

- Commercial Real Estate: At some point a commercial real estate lender will probably want to run your personal and business credit to check your payment history. But in the meantime, its not unusual to get a preapproval and even a term sheet without having a credit check run, because the foundation of the financing will be based on the commercial real estate itself.

- ACH Cash Advances: much like a MCA split, an ACH cash advance is the sale of future business receivables at a discount to the funder. The difference between an ACH and MCA loan is the way the lender is repaid. With an ACH cash advance the lender isn’t repaid using merchant accounts, but by collecting a set amount from the small business’s bank account each business day using Automated Clearing House.

Conclusion

While the great majority of lenders and funders will want to run your business and personal credit before evaluating your business for preapproval and before offering a term sheet or other type of offer. If you choose to use the wrong broker, you may find yourself in a situation where your financial documents are sent out to dozens of lenders at the same time – all of them running your credit. If you’re looking for small business lending options without having your credit pulled needlessly, please reach out to our experts and they will walk you through the process.