Ohio Small Business Funding

Despite many obstacles, the state of Ohio has seen positive business and employment growth in recent years, which has led to major industries, especially the technology industry, flourishing in Ohio. With the positive growth in business comes the need for increased business financing. In this article we will discuss all the financing options available to small and mid-sized businesses in Ohio.

The State of Ohio Small Businesses

Even before the major economic crisis of 2008, Ohio was experiencing a rapidly depleting economy with decreasing employment rates – most of which can be contributed to the state’s dependence on a few major industries, such as the manufacturing sector. Once the manufacturing sector declined, income, employment, and business growth all declined by 2007.

By focusing on only a few major companies to employ a majority of the workforce in Ohio, many businesses and families suffered. Now, the state of Ohio is working hard to make sure that small businesses are offered every opportunity to succeed. By the end of 2015, there were 927,691 small businesses in Ohio, which is 97.9 percent of all businesses in the state. In addition, those same small businesses employed 2.1 million laborers, which equates to 46.2 percent of the civilian workforce. Overall in 2015, small Ohio businesses created 11,689 net new jobs, and increased their minority business ownership rates by 48.9 percent. Ohio’s economy also grew at an annual rate of 2.3 percent, which is faster than the country’s overall growth rate. With this being said, there are still many obstacles that business owners in Ohio are facing today.

Benefits of Running a Business in Ohio

The state of Ohio has seen some good times and some bad times, but overall, business owners across the state are optimistic of the next few years. As small businesses create more dominance in the business sectors in Ohio, employment opportunities are opening up, as well as many other benefits. Some of the popular reasons that business owners in Ohio are feeling positive about the next few years include:

- Small Business Growth with Community Support: Small businesses have become a vital staple in the Ohio economy, especially because this midwestern state has proven to have a history of putting all of their eggs into one basket. One of the biggest reasons that the state of Ohio felt the economic recession before the rest of the United States was due to the limited amount of businesses in Ohio that fueled the entire state’s economy. As small businesses continue to become prevalent, and as more small businesses work towards differentiating themselves from the competition to remain ahead of other businesses, the state of Ohio will be shifting away from this reliance on a few, select industries. Another added benefit to running a small business in Ohio is the overwhelming support from the surrounding communities. Across the United States, people everywhere are determined to “shop local” and to support their local economies – and Ohio is reaping the rewards of this new trend. Through continued support from surrounding communities, small businesses throughout Ohio are benefiting.

- Innovative Startup Industries: When major big businesses that the Ohio economy relied on started to fail, the state struggled with major layoffs and other economic issues. Today, innovative startups, especially the technology, IT, and fintech industries are creating innovative, creative business ideas to help boost the economy throughout the state. Many people assume that the midwestern state is all farming, but the booming and rapidly growing tech industry has become an integral part of the state’s economy.

- Decent Tax Regulations: While Ohio is no Texas with almost nonexistent tax regulations, it is far from strict, high taxed states like California. After seeing the positive effects of small businesses in Ohio, state government officials have decided to work towards helping all of those vital small businesses succeed. More often than not, Ohio small business owners claim that the tax systems and regulations in Ohio are manageable. The state of Ohio has worked hard to help businesses flourish, especially with the help of many small, local organizations that work with small businesses to help those Ohio small business owners find sufficient funding, support, and training to be successful.

Challenges of Running a Business in Ohio

There are many benefits to running a business in Ohio, and more often than not, these benefits greatly outweigh the difficulties faced by businesses in Ohio. Unfortunately, many of the issues being faced by Ohio business owners are challenges that are affecting the whole country, not just the state of Ohio. Some of the challenges being faced by Ohio business owners include:

- Lack of Qualified, Skilled Workers: As the unemployment rate in Ohio continues to lower, so does the amount of available, qualified, and skilled workers – especially in a state that is an integral part to the constantly growing tech industry that requires specific skill sets. In order to combat this issue, many local organizations throughout the state are working to offer, and even pay for, on the job training. In addition, many organizations in Ohio are finding ways to offer affordable classes to help mitigate education requirements. Another step that the state of Ohio is taking to support employment growth is working with state legislatures to offer specific skills in the public education system to children at a young age. Unfortunately, this has caused a lot of controversy in major cities that feel like this system should be an option for teachers with whom this fits with, instead of a requirement for all teachers – but at least the city officials are making this obstacle a priority!

- Economic Diversity in the Midwest: As mentioned above, one of the major contributing factors to the economic recession in Ohio was due to the lack of economic diversity – a struggle faced by many midwestern states. Relying on a few large industries to support an entire state has proven to be detrimental, and unfortunately, Ohio is still in the early stages of transitioning from this economic reliance. Even as small businesses in Ohio start to grow and become more prevalent, these small businesses are still utilizing vendors from an incredibly small market! These Ohio small businesses only have a few options for obtaining the supplies and inventory they need to keep their businesses operating, and those vendors are the small group that supports most of the state’s economy. This has been a major challenge for most businesses in Ohio today.

Some Ohio Cities We Provide Financing In:

- Columbus

- Cleveland

- Cincinnati

- Toledo

- Akron

- Dayton

- Parma

- Canton

- Youngstown

- Lorain

- Hamilton

- Springfield

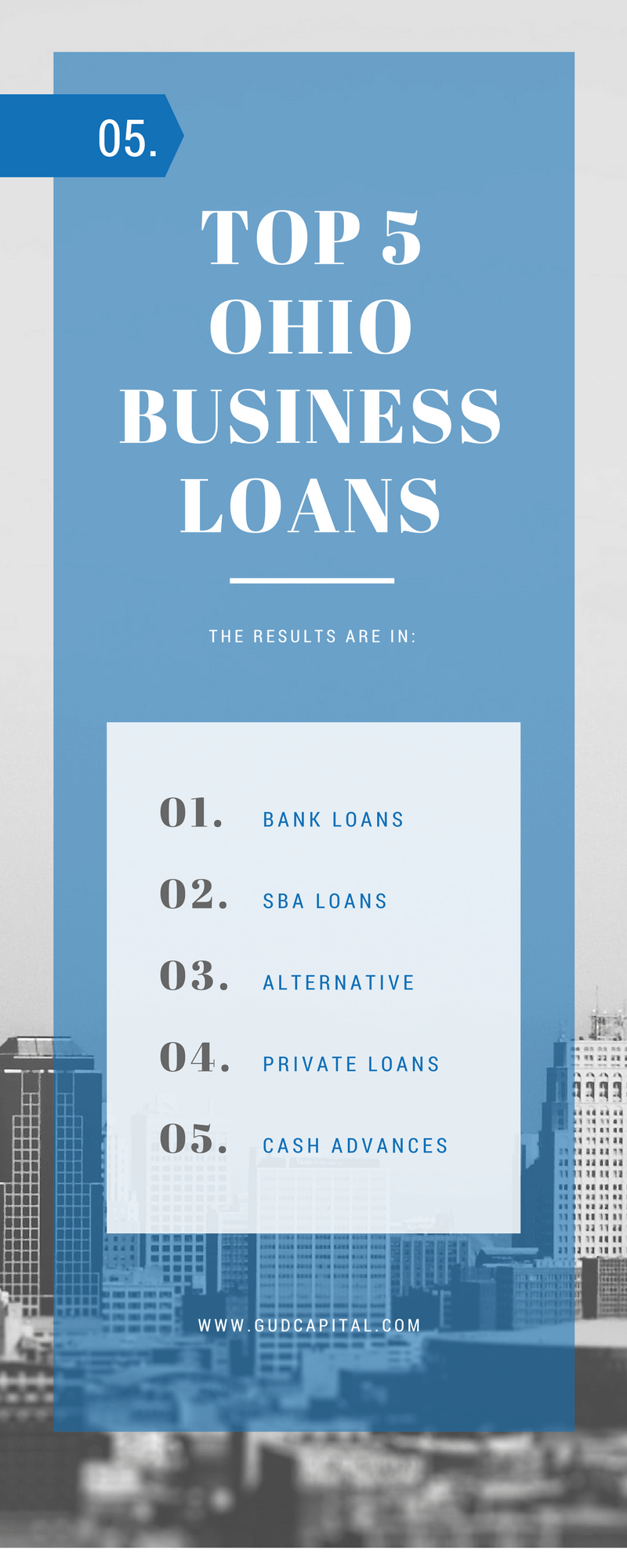

Ohio Conventional Bank Loans

Conventional business financing from institutions like big and small banks are clearly the best type of business funding, not only for Ohio small businesses, but for any company in need of financing. Typical uses of conventional business loans include purchasing commercial real estate, refinancing commercial mortgages, general working capital uses, upgrades and build outs, and other expansion purposes.

Ohio SBA Loans

SBA loans have a lot of similarities as the types of financing offered by conventional lenders, because SBA lending is provided by suck traditional lending institutions. Ohio SBA loans aren’t are funded by the Small Business Administration or the government. They are funded by small banks, large banks, credit unions and community business lenders and the SBA agrees to cover a large portion of the SBA lender’s losses should the Ohio business fail to repay their loan. SBA loans are commonly-used for business acquisitions, refinancing and consolidation of business debt, operating capital and purchasing business equipment.

Alternative Ohio Business Loans

Ohio Alternative loans for small businesses are a good way for companies to get affordable business financing without the documentation, credit and profitability requirements that would be required by conventional and SBA lenders. Ohio small businesses seeking alternative financing can expect to find-out about approvals within a few minutes, and should see their loan funded within 7-10 days, if not sooner. Common uses for alternative Ohio business funding include fast working capital, marketing expenses, hiring employees and other short-term business uses.

Ohio Business Cash Advances

Cash advances are definitely not a form of low-rate business financing. In fact, merchant cash advances may be the most expensive type of business financing available to small businesses in Ohio. On top of the high rates, business cash advances have terms that are much shorter than all other types of business loans. Cash advances aren’t loans at all, but are a form of business financing that involves the company selling a portion of their future business revenue at a discount to the lender. While the rates of a cash advance can be exorbitant, they are relatively easy to obtain, with 95% of all companies that apply being approved.