Loans For Texas Small Businesses

Texas is arguably one of the best states to conduct business in throughout the United States. The state of Texas has very limited corporate tax structures and nonexistent personal income taxes for business owners, which has created an incredibly business-friendly state. Texas has a $1.6 trillion gross domestic product (GDP), which is second to California’s GDP. Ultimately, this helped the state rapidly recover from the 2008 recession, leading to one of the quickest and most robust recoveries in the country.

The State of Texas Small Businesses

Small businesses in Texas are thriving today, with over 2.4 million of businesses in Texas being small businesses (which equates to 98.6 percent). With a phenomenal business, regulation, and tax climate, small businesses in Texas employ 4.4 million people, which is around 45.6 percent of the civilian labor force. Small businesses in Texas have created 152,231 net new jobs in the past year, have had a 48 percent increase in minority ownership, and comprise 93.2 percent of Texas exporters. Overall, businesses throughout the state of Texas are flourishing.

Benefits of Owning a Business in Texas

If you talk to any business owner in the state of Texas, more often than not, you will hear about how great it is to run a business in Texas. With some of the lowest tax rates in the United States, and with the local Texan government working hard to continuously provide benefits to businesses of all sizes in the state, things are only looking up for business owners in every industry in Texas. The benefits of owning a business of any size in Texas has played a vital role in contributing to low unemployment rates, increased total payrolls, and a regularly increasing labor participation rate. Overall, the biggest perks of running a business in the state of Texas include:

- One of the Most Middle Market Business Friendly States: According to the National Center for the Middle Market, Texas is one of the most middle market friendly states to conduct business in throughout the United States. Studies from the fourth quarter of 2013 from the National Center for the Middle Market show that middle market companies based in Texas beat the national average in revenue growth within those twelve months, reaching 6.5 percent (5 percent was the national average during 2013). Each year, middle market companies in Texas surpass the national average, resulting in a friendly environment for all middle market companies in Texas.

- Benefits to Trade Related Industries: Business sectors such as agriculture, technology, finance, warehousing, construction, and consumer services in Texas rely heavily on trade to fuel and grow their businesses. In 2013 alone, 93 percent of exporters in Texas were small and medium sized businesses; based on the information above regarding the percentage of small businesses in Texas, the data shows how vital trade is in Texas. This has led to Texan state officials putting in place valuable regulations that support vital and robust trade in the state to help all businesses thrive.

- Extremely Low Corporate Taxes and Nonexistent Personal Income Taxes: Texas has experienced rapid job growth and consistently lowering unemployment rates year over year, which can be directly correlated to the extremely low corporate taxes that all businesses benefit from in the state, as well as the lack of personal income taxes. Due to these low tax rates and burdens, Texas has experienced healthy payroll and labor participation rate increases; whereas the rest of the United States has experienced stagnant, if not declining, payroll and labor participation rates over the past few years. The tax climate in Texas has made the state one of the best states to conduct business in throughout the country.

Challenges Faced by Texas Businesses

While there are endless amounts of positive reasons to conduct business in Texas, some business owners are still struggling with unresolved issues. Most business owners are satisfied with the regulations and tax requirements for the state of Texas, but many company owners are concerned that local officials in Texas will stop fixing and progressing business regulations. Just because regulations are better in the state of Texas than most other states, does not mean there are not ways that the system and regulations can improve! Some of the biggest complaints from business owners about doing business in the state of Texas include:

- Increasing Population Driving the Cost of Living Up: Most states in the country today are being faced with increasing populations, which ultimately increase the cost of living. This greatly affects the cost of doing business, especially in a state that is promoting the huge benefits to doing business in Texas. By encouraging more and more business owners to base their businesses in Texas, this fuels the growing concern for increasing costs of living.

- Limited Financial Help for Startups and Minority Owned Businesses: This is by far one of the biggest issues plaguing business owners in Texas. Across the United States, banks are not lending capital like they used to, and this is even more so in an overly conservative state. While starting businesses in the major cities throughout Texas allows a little more access to financing options, those small and/or minority owned businesses in rural areas are struggling to find any access to financing. Many business owners in these areas do not have the ability to find venture capitalists or angel investors, but when the banks in the areas are not providing much support either, many small and/or minority owned business owners are left with very little options. By working with organizations like the Small Business Administration, or by contacting local government officials to encourage progress in antiquated regulations, some of these financing burdens can be addressed.

- Declining Labor Force: This particular challenge that Texan businesses are facing is a double edge sword. Unemployment rates are lower than ever before in the state, and businesses across Texas are remaining optimistic because of the business friendly environment that the state has created. Unfortunately, when most businesses in Texas are thriving, and most of the civilian labor force is already employed, the amount of skilled, qualified workers for specialized positions is limited. Overall, Texas is being forced to address this dilemma: combating the declining labor force and increasing expenses associated with finding highly qualified and skilled workers.

Some Texas Cities We Provide Financing In:

- Houston

- San Antonio

- Dallas

- Austin

- Forth Worth

- El Paso

- Arlington

- Corpus Christi

- Plano

- Laredo

- Lubbock

- Garland

- Irving

- Amarillo

Texas Bank Loans

Business bank loans for Texas companies clearly offer the best type of financing for a growing or established business. While a bank loan isn’t necessarily easy to qualify for, if you are capable of being approved for conventional bank financing, you’re going to be getting the best rates and terms available. Bank loans are used to help business owner purchase commercial real estate or refinance and existing business mortgage, refinance and consolidate business debt, and capital to help with operations.

Documents needed to get a Texas bank loan:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

Texas SBA Loans

Most people tend to think SBA loans are a form of business financing provided directly from the government to small companies. Fact is, SBA loans are not provided by the government, but are instead provided by conventional business lenders (small banks, large banks, credit unions, community lenders) and the loan is enhanced with an SBA guarantee. The SBA loan guarantee covers a large percentage of the lender’s exposure by agreeing to pay the lender for a majority of the loans value if the Texas small business fails to repay loan.

Documents Needed For Texas SBA financing:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

- Personal tax returns

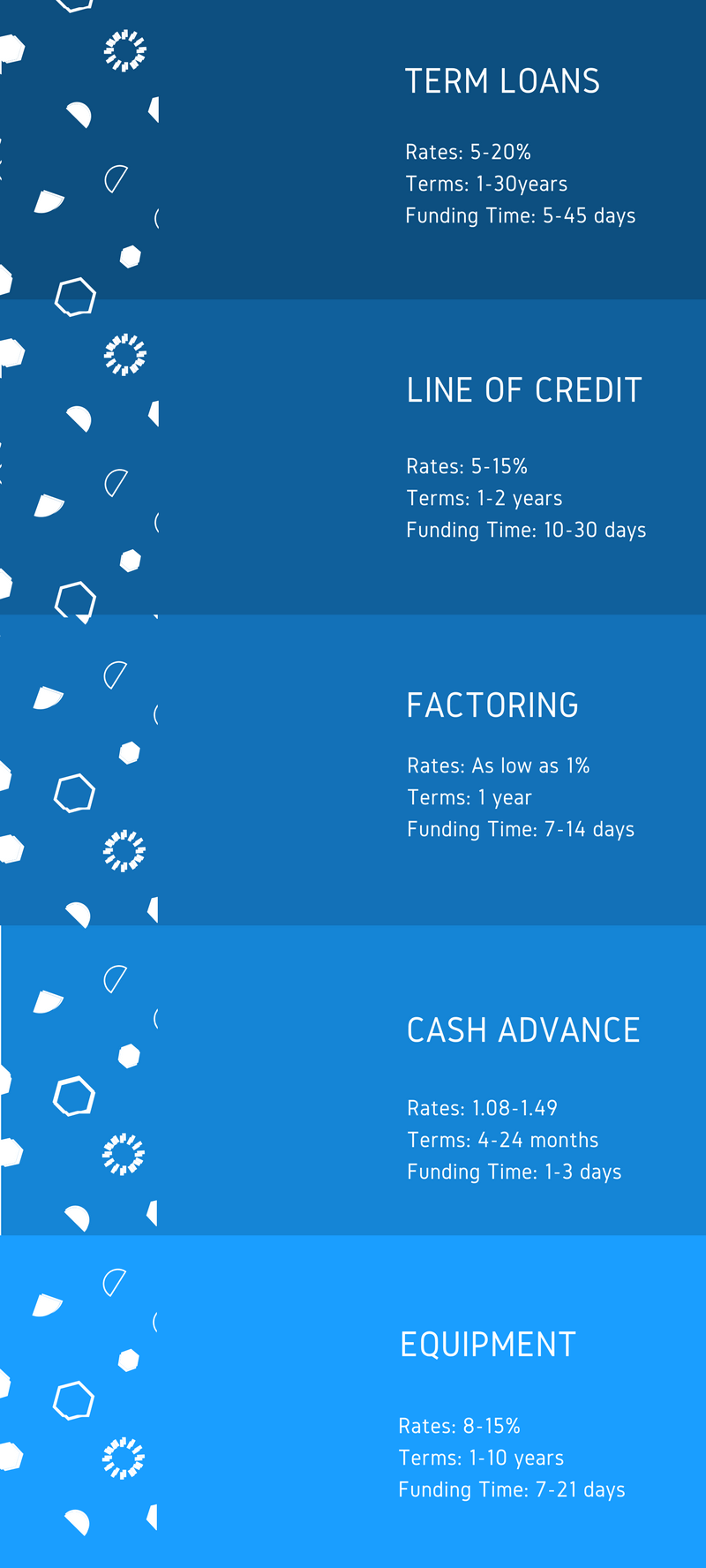

Alternative Texas Business Loans

Alternative business loans for Texas companies are a way for lone-star state small business to acquire affordable financing without the hassles of dealing with a bank. Many alternative online lenders (fintech lenders) are able to use technology to speed up the funding process, taking a fraction of the time a bank would to approve and fund a loan. Alternative business loans can be approved in a matter of minutes online, and usually fund within a week.

Texas alternative business loan documents:

- Tax returns

- P&L

- Debt Schedule

- Application

- Bank statements

Texas Business Cash Advances

Sometimes a Texas business may find themselves in need of immediate business cash to help take care of a working capital expense. While it would be great to simply go to your local bank and request immediate funds, chances are its not going to happen. When a company needs cash, has bad credit or lacks the documentation needed for conventional business financing, a good option would be to obtain a merchant cash advance. A cash advance is the sale of the Texas companies future receivables at a discount to the lender. Approvals are instantaneous and funding occurs within a day or two, and sometimes even the same day.

Texas business cash advance documents:

- Application

- Bank statements

- Credit card statements