Pediatric Business Funding

Pediatricians are physicians who work with children and young adults. While most doctors focus on physical ailments, pediatricians work with patients who cannot always articulate what is wrong or what hurts, forcing these medical physicians to focus on physical, emotional, and social needs while working with their patient’s families. With any business, pediatrician businesses experiencing many fluctuations based on a variety of factors such as patient’s access to healthcare, income, and so forth. However, the pediatrician business sector in particular is expected to have continuous growth in terms of patients because of the rapidly increasing birth rates in the United States.

The pediatrician business industry is incredibly profitable, with the average annual wage being around $168,990, according to the Bureau of Labor Statistics. Not only is the pediatrician business sector very lucrative, it also employs over 26,000 people. As mentioned above, birth rates are rapidly growing in the United States, leading to a higher dependence on pediatrician care than ever before, making the outlook for the pediatrician business industry strong. The Bureau of Labor Statistics show that there is an expected 10 percent growth in employment for the pediatrician sector from 2014 to 2024, which is faster than the average for all occupations!

Pediatrician Business Sector Trends

Being a pediatrician is incredibly profitable and rewarding, but every pediatrician business is being forced to change the way they run their business. There are many trends affecting not only pediatrician businesses, but the entire healthcare system. With the new presidency, there are a lot of unknown factors for doctor offices everywhere. Some of the other important pediatrician business trends include:

- Dealing with the Prevalence of Chronic Diseases in Children: Chronic conditions such as diabetes and obesity are at an all-time high for young children. Many pediatrician business owners are working towards incorporating new health care models for young patients with these devastating chronic diseases that will impact these children for the rest of their lives if not treated and managed well. Many pediatrician businesses are focusing on transitioning into a patient centered home treatment outlook. This means that pediatricians are working hard to communicate well with parents and children in hopes of facilitating a strong, well-informed family based treatment course. By educating families on the impacts of these chronic diseases while effectively teaching these families how to manage and/or treat these conditions at home, pediatrician businesses everywhere are working to fix these chronic diseases.

- Technologies in Healthcare: Many doctors now manage things online, offer online portals for patients to review their tests or to communicate with their doctor, and take notes and other important information all online. Let’s face it – society is revolving around new, innovative technologies that are no longer avoidable. By incorporating new, exciting technologies, pediatrician business owners everywhere are revolutionizing the way they run their businesses.

Pediatrician Business Financing Uses

Overall, the pediatrician medical practice sector is doing well and is expected to continuously grow in profitability over the next few years due to constantly rising birth rates. However, every single business, regardless of the industry, experiences ups and downs, resulting in the need for quick financing options. Some of the most common uses for financing for pediatrician businesses include:

- Pediatrician Business Loans for Technologies: As mentioned above, new technologies are constantly being created and implemented in the pediatrician business world. Innovation of new, creative technologies is essential to providing the best health care for children everywhere, which is why it is so important to stay up to date on the most relevant and useful pediatrician business technologies and medical devices. Unfortunately, many of the technologies that pediatrician businesses would benefit from are incredibly expensive up front – but they are simply unavoidable if a pediatrician business owner wants to provide the best possible care. With the help of pediatrician company loans for various innovative technologies, any pediatrician business owner can make sure that the pediatrician company has access to quality technologies that will benefit all children.

- Pediatrician Company Inventory Financing: Anyone that has ever been to a doctor’s office is well aware of the various vital inventory items that every doctor needs. Some of these inventory items include gloves, tongue depressors, topical creams, and so much more – and with a pediatrician business office, they always have something to give to the kids, such as stickers! Having all of these important inventory items is vital to sustaining, maintaining, and growing any pediatrician business. There are a variety of pediatrician business loans to help cover inventory costs.

- Pediatrician Business Funding for Marketing, Advertising, and Social Media: As mentioned above, new technologies are constantly being created to help make businesses more successful. In today’s society, marketing and advertising through these technologies, especially social media and content marketing, are essential to creating a successful pediatrician company. Whether a pediatrician business owner wants to hire a person to handle online marketing and advertising in house or hire a third-party marketing firm to handle the ins and outs of online marketing, there are plenty of pediatrician business funding choices to help cover these vital marketing and advertising costs.

- Pediatrician Business Equipment Financing: Every doctor’s office must have access to many different types of equipment in order to provide quality health care. Sometimes, pediatricians will refer a patient to a specific facility to handle more complex tests and procedures, but having in house access to certain types of equipment can be incredibly beneficial, more efficient, and more profitable for that pediatrician business owner. Unfortunately, many pieces of equipment for pediatrician businesses can be incredibly expensive up-front costs that most pediatrician business owners cannot afford. With the help of pediatrician business equipment financing options, many pediatrician business owners can purchase these vital pieces of equipment without paying the full, upfront costs.

- Pediatrician Business Loans for Expansions and Renovations: The thought of expanding and/or renovating a pediatrician office space is always an exciting idea for any business owner. However, with expansions and renovations comes a lot of unknown situations that can lead to a bunch of unplanned expenses. By utilizing pediatrician business loans for expansions and renovations, many pediatrician business owners can successfully expand their practice.

Pediatrician Practice Bank Loans

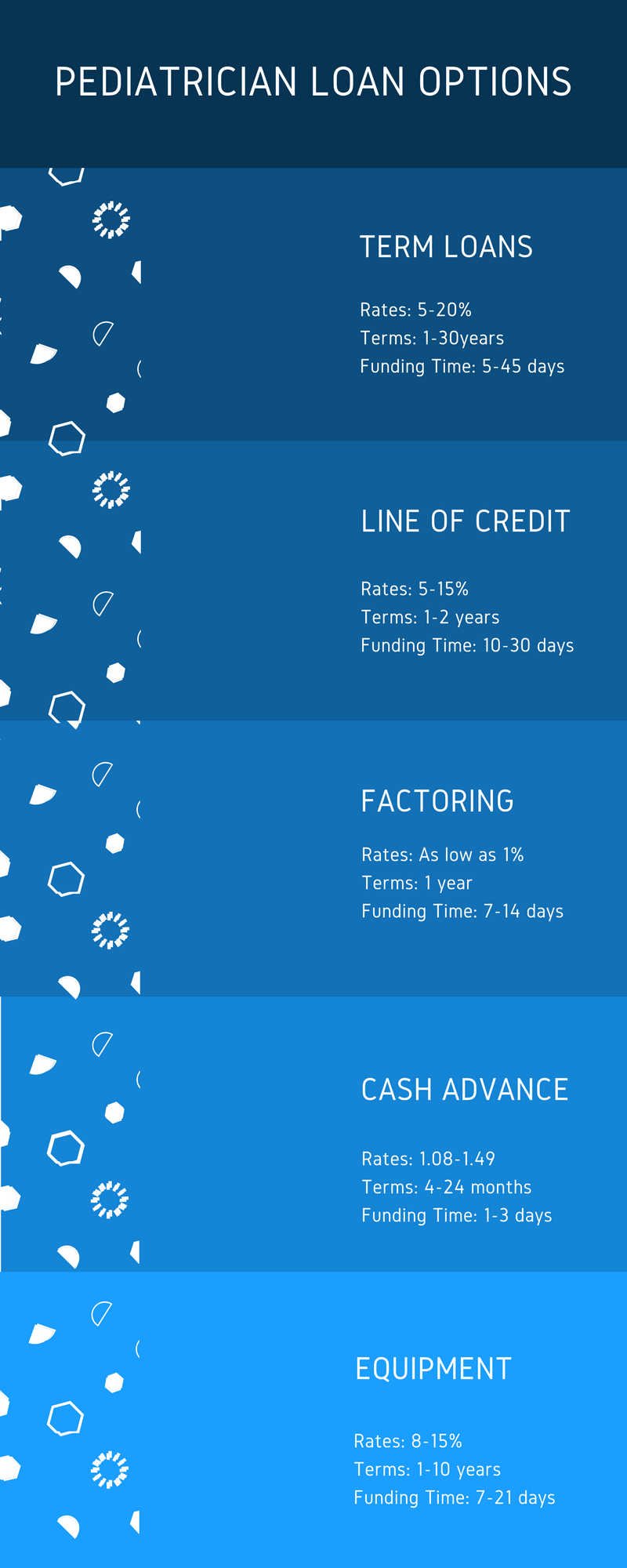

Pediatrician businesses generally turn to banks (both large and small) as well as community lenders and credit unions to obtain conventional term loans and lines of credit with the best rates and terms for a variety of business uses, including purchasing the pediatric practice commercial space, purchase new business equipment, refinancing the pediatric practice’s business debt, operating capital and other uses. While the process of obtaining traditional business financing is never easy, its always preferable to some of the high-interest, high-risk business lending options available to small businesses.

Pediatrician SBA Loans

Many new and existing pediatric business practices turn to SBA lending for their businesses because of the access the Small Business Administration’s programs provide to affordable financing. SBA lending is very similar to the rates and terms you’d get from a traditional lender because the SBA loans are actually provided by conventional lenders, and the Small Business Administration backs-up the loan. By “back-up” we mean that the government agrees to cover lender losses if the pediatrician fails to repay the loan.

Alternative Pediatrician Business Loans

Pediatric alternative business lending is the perfect type of loan for practices that need funding faster than conventional lenders can provide, or don’t quite have the credit or profitability required by traditional and SBA preferred lenders. With minimal business and personal documentation, an alternative lender can provide a pediatric practice with a preapproval in a matter of minutes, and can complete funding in a week or less. Uses for alternative fintech loans are mostly for working capital and general purchases, but can be used for just about any need the medical practice may have.

Pediatrician Cash Advance

If a pediatrician is in need of cash almost immediately, and don’t want to go through the headaches involved with conventional lending and most alternative funding options, a good choice could be a merchant cash advance or business advance. Cash advances aren’t loans but the sale of the pediatric practice’s future receivables (in the form of either merchant accounts, or business bank accounts). Since cash advances rely mostly on the business’s revenue, a pediatrician can get approved with bad credit. Cash advances can be approved immediately and fund within a couple of days, or even the same day if the right conditions are in place.