New York Business Lending

New York has a massive economy and one of the busiest regions for businesses in the United States, allowing many New York business owners to feel optimistic about the next business year. New York is still the United States’ third largest economy with a gross domestic product (GDP) of almost $1.4 trillion in 2014. New York City’s economy alone grew at an annual rate of 1.7 percent, which is over 670.7 billion by the fourth quarter of 2015. In 2016, New York City’s economy grew at an annual rate of 1.9 percent, with expectations of 2017 to hit a growth rate of 2.7 percent by the fourth quarter.

Overall, the business economy in New York is rapidly growing, leading to an increased number of small business opening and higher employment rates throughout the New York. Throughout 2016, private sector employment in New York grew for the first time in three months, reversing a job loss streak. This led to total gains of one thousand jobs from November to December in 2016. This was predominately fueled by growth in the health care sector, followed by food services and construction sectors. Overall, by the end of 2015, New York added over 63,000 jobs.

The State of New York Small Businesses

The Small Business Administration’s Small Business Profile report has shown that 2.1 million businesses in New York, or 99 percent of businesses, are small businesses. This means that almost all of the businesses in New York are small businesses that employ 3.9 million people, which is around 50.6 percent of the workers in New York. The Small Business Administration report also shows that small New York businesses with fewer than 100 employees have the largest share of small business employment. By the end of 2015, there was a total of 57,244 net new jobs with a 31.9 percent increase in minority ownership of small New York businesses. Here is a breakdown of business ownership:

- African American owned – 7.4 percent

- Asian owned – 23.5 percent

- Hawaiian and Pacific Islander owned – 49 percent

- Hispanic owned – 38 percent

- Native American or Alaskan owned – 1.3 percent

- Minority owned – 31.9 percent

- Nonminority owned – -6.3 percent

Small businesses are essentially the lifeblood of New York, which is why New York has spent so much time and money on fixing state regulations to help small New York businesses thrive. Other major small business statistics for New York include:

- New York was ranked the 5th most entrepreneurial state in the country (based off of the number, size, and increased number of Small Business Administration loans; venture capital funding; and overall growth of small business population for each state).

- In 2014, New York was ranked third in the United States for the amount of patents awarded, leading to small patent firms producing thirteen times more patents per employee than large patenting firms.

- More than 2 million New York small businesses are located in every region, community, and neighborhood of the state.

- Between 2013 and 2014, New York small businesses ranked 8th in the percentage of small businesses that started in 2013 and survived into 2014, which equates to 80.7 percent.

- Over one-fourth of the land in New York is dedicated to the agriculture business industry, allowing New York businesses to rank 2nd in the United States in production of apples, maple syrup, cabbage, and snap beans in 2014.

Challenges Faced by New York Businesses

New York businesses were thriving at the start of 2017, and there are high expectations and plenty of optimism that this trend for New York businesses will continue. While there are many exciting benefits to running a business in New York, there are a few areas that many business owners in New York are struggling to adjust to. Some of the biggest challenges being faced by New York businesses today, especially small New York businesses, include:

- High Rents: Every year, rent prices increase in New York, especially in the heavily populated metropolitan areas, which can make keeping a thriving business afloat difficult. More now than ever, New York businesses that have been pillars of their communities are being forced to close up shop because of the high rent prices. These high rent prices are also prohibiting many entrepreneurial business owners from growing their businesses, preventing many of these New York business owners from hiring more employees and growing their local economies. Some suggestions that New York businesses are receiving today consist of thoroughly evaluating the numbers and looking into the finances of a building before signing any official papers and renting. Consulting with outside help is always best to avoid these frustrating situations.

- Strict Regulations, High Priced Fines, and a Confusing Web of Taxes: New York is not known for having particularly high taxes, but New York business owners are faced with a lot of different types of taxes, regulations, and fees, making it difficult for many new business owners in New York to understand the complex tax system. To make matters more difficult, the Department of Taxation and Finance in New York is well-funded, educated, and on top of making sure every business is following all the various tax codes and regulations in the state. Luckily, New York state is always available to help New York business owners who are unsure of how to understand and comply with all of the various taxes and regulations.

- Increasing Wages and Salaries: As if dealing with rising rent prices was not already making finances difficult for New York business owners, increasing wages and salaries are leaving many business owners in New York unsure of how to cover all of these rising costs. In addition, the overall costs of living in New York are adding an unprecedented amount of pressure to New York businesses. Once again, focusing on working with a financial advisor before making any big decisions is always the best route when battling rising wages, salaries, and rent costs.

New York Conventional Bank Loans

Conventional business lenders (large and small banks, credit unions, community lenders, non-profit lenders) offer the best types of financing for New York state small businesses, because they offer the lower rates and longest terms of all business lenders. Conventional loans are used for purchasing businesses, purchasing property, buildings or other commercial real estate, making major renovations facility, general working capital uses, as well as purchasing equipment and machinery.

New York State SBA Loans

While SBA loans aren’t necessarily as low as the top of the line business lending facilities, they are almost comparable, in that the rates are usually in the 6-8% range, and the terms are usually between 3-25 years depending upon uses. SBA loans are great NY State companies looking to acquire other businesses, purchase their commercial real estate, refinance their commercial property or other loans and mortgages, consolidate business debt into lower payments, as well as operating capital for business growth.

Alternative New York Business Loans

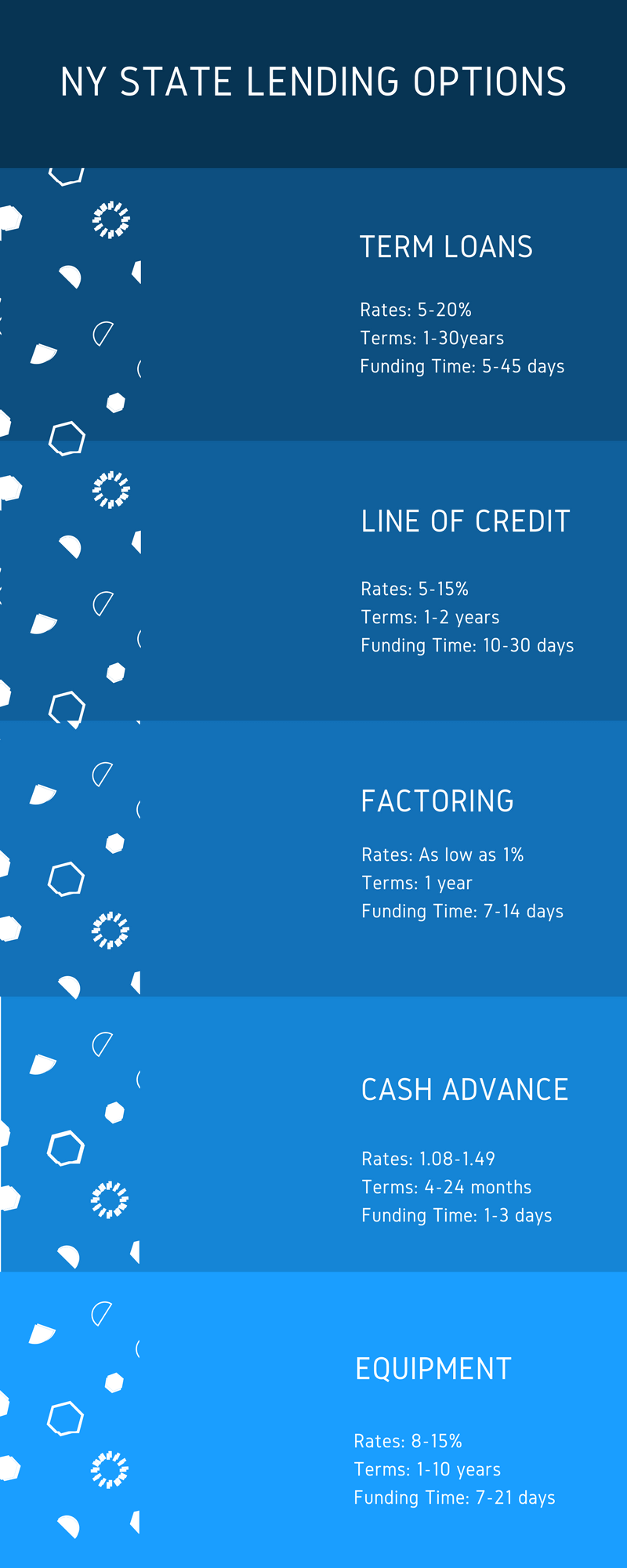

Alternative business lending (sometimes referred to as fintech business loans or marketplace lending) is a great way for a New York business to obtain financing quickly, without the hassles associated with bank business lending. New York companies use alternative loans to purchase business inventory, help pay for expansion of their businesses, help their small business make payroll, purchase equipment and machinery and just about any other short-term business financing use for operational needs.

New York State Merchant Cash Advance

A merchant cash advance (sometimes referred to as a business cash advance) is a way for small businesses to obtain unconventional financing from non-bank lenders. Cash advances are structured much differently than a business loan, because they aren’t a loan at all, but the sale of the New York state business’s future sales revenue (usually either bank deposits are credit card processing sales) to a funder in exchange for short-term capital.