Agriculture Business Financing

When people hear the term “agriculture”, they often think of farmers and ranchers in the Midwest – but the reality of what consists of the agriculture business sector is much more complex. Farms, ranches, orchards, and feedlots all play a role in the production sector of agriculture businesses. After the food, or meat, is produced, the products must then be transported and sold to businesses that can provide consumers access to this food. There are so many different industries involved in the agriculture business supply chain, such as food processing companies, restaurants, supermarkets, and other retail sectors.

According to the United States Department of Agriculture, in 2014, the agriculture business industry provided over 2.6 million direct, on farm jobs – but it does not stop there! In the same year, agriculture related industries employed and supported over 14.7 million jobs. These business sectors include food services and drinking places; farming; forestry, fishing, and related activities; food, beverage, and tobacco manufacturing; and textile, apparel, and leather manufacturing.

Not only does the agriculture business industry and related agriculture industries play a vital role in United States job growth, but these companies also greatly contribute to the United States gross domestic product (GDP). In 2014, these agriculture businesses contributed $985 billion to the national gross domestic product, which equates to 5.7 percent. The agriculture business sector is a vital component to the United States and the world, but there are many factors that are disrupting the incumbent ways of agricultural production. Staying ahead of these vital shifts are necessary for growth in the agriculture business world.

Agriculture Business Trends

The agriculture business world is at a tipping point in today’s society – should farmers focus on producing sustainably grown foods, or should farmers continue down the industrialized agricultural path that is only profiting the major food corporations? Well, as more and more consumers demand environmentally friendly products from every single business industry in the United States, ingrained ideals of how food should be produced are coming into question. Processed foods, meats, and unsustainably produced fruits and vegetables played a vital economic role in the United States for years, but as consumers become more aware of what is being done to their food, they are becoming more vocal. Through the growing demands for changes to how their food is being processed, farmers everywhere are transitioning into these vital agriculture business trends:

- Organic, Grass Fed, and Locally Grown Foods: As every single business industry is aware of today, organic is the new trend. Not only is it a trend, but it is presumed to become commonplace in society. Consumers today are vigilant about how their foods are produced, as well as what they put into their bodies. Focusing on organic and locally grown foods is one of the biggest trends being faced by the agriculture business sector today. There are plenty of different ways that this can be done – whether a farmer is focusing on organically produced agricultural foods (meaning pesticide and herbicide free, as well as genetically modified organism free), focusing on humanely raised and grass fed meat, focusing on producing and selling sustainably grown food locally, or all of the above. Either way, this agricultural business trend is here to stay, and has been shown to be a driving force in the downfall of industrial, big agriculture businesses.

- Climate Change and Environmental Concerns: Sustainability is a major topic on the minds of every single American today. Many business industries are focusing on producing more sustainable and environmentally friendly products for consumers, but many people are starting to push for better agricultural practices. Industrialized and non-organic agriculture practices have greatly impacted the environment today, wasting more resources than many other industries. Many farmers today are trying to shift their focus away from pesticide use and inefficient practices to meet the growing demands of consumers everywhere.

- Agricultural Industrialization and Food Processing: The industrialization of agriculture started in the early 1800s, but the agricultural business community did not fully adopt many of the industrialized practices until after World War II. After the war, technologies in the United States rapidly improved, leading to the development of mechanized agricultural production, which ultimately led to the consolidation of the agriculture business sector that pushed out many small, local farmers. Today, consumers are demanding that agriculture businesses shift back into small farming practices and away from unsustainable and industrialized agriculture.

Agriculture Business Financing Uses

Many agriculture businesses in the United States are seeing rapid growth today as food demands increase, which is great news for most farmers. Unfortunately, every business industry experiences financial fluctuations that can damage profits. This is why there are a variety of agriculture business financing options. Some of the most common uses for agriculture business loans include:

- Agriculture Business Funding for New Technologies: Technology is revolutionizing many businesses today in the agriculture business sector. There is always a growing demand for improved technologies that are more efficient, effective, and affordable. By utilizing agriculture business financing for new technologies, many agriculture farmers will have access to better technologies that will boost business profits.

- Agriculture Business Equipment Financing: Having access to quality, top of the line equipment is essential in any agriculture business, but being able to afford these new pieces of equipment can be almost impossible for many farmers – especially small scale farmers. Through agriculture business equipment financing, small farmers can obtain the necessary equipment needed to keep their business running without paying the full cost up front.

- Agriculture Business Loan for Payroll and Hiring New Employees: Having experienced and dedicated workers is important for any business. With the agriculture business sector, the dependence on workers has lessened, but there is still a major component of farming that requires hands on work. Covering the costs of payroll, or the costs of hiring a new employee, can be incredibly expensive up front. Considering agriculture business loan options for payroll and hiring a new employee can help.

- Agriculture Business Financing for Marketing and Advertising: Every single business in the United States, including agriculture businesses, are now dependent on effective marketing and advertising through social media and content marketing. These marketing techniques can be time consuming and confusing to learn. Through agriculture business financing for marketing and advertising, agriculture business owners can hire in house help, or third party marketing companies to manage this vital business practice.

- Working Capital: Having sufficient working capital to help with your agricultural business operations is an absolute necessity. Having enough money on hand may be the difference between making payroll, paying a vendor, or dealing with emergency funding uses.

Some Industries We Provide Agribusiness Loan Assistance :

- Farm Loans

- Cotton Industry

- Dairy

- Environmental Compliance

- Farming

- Fisheries

- Forestry

- Fruit & Vegetables

- Grain

- Horticulture

- International Trade

- Livestock

- Organic Food

- Pesticides

- Poultry

- Seed

- Tobacco

- Veterinary Medicine

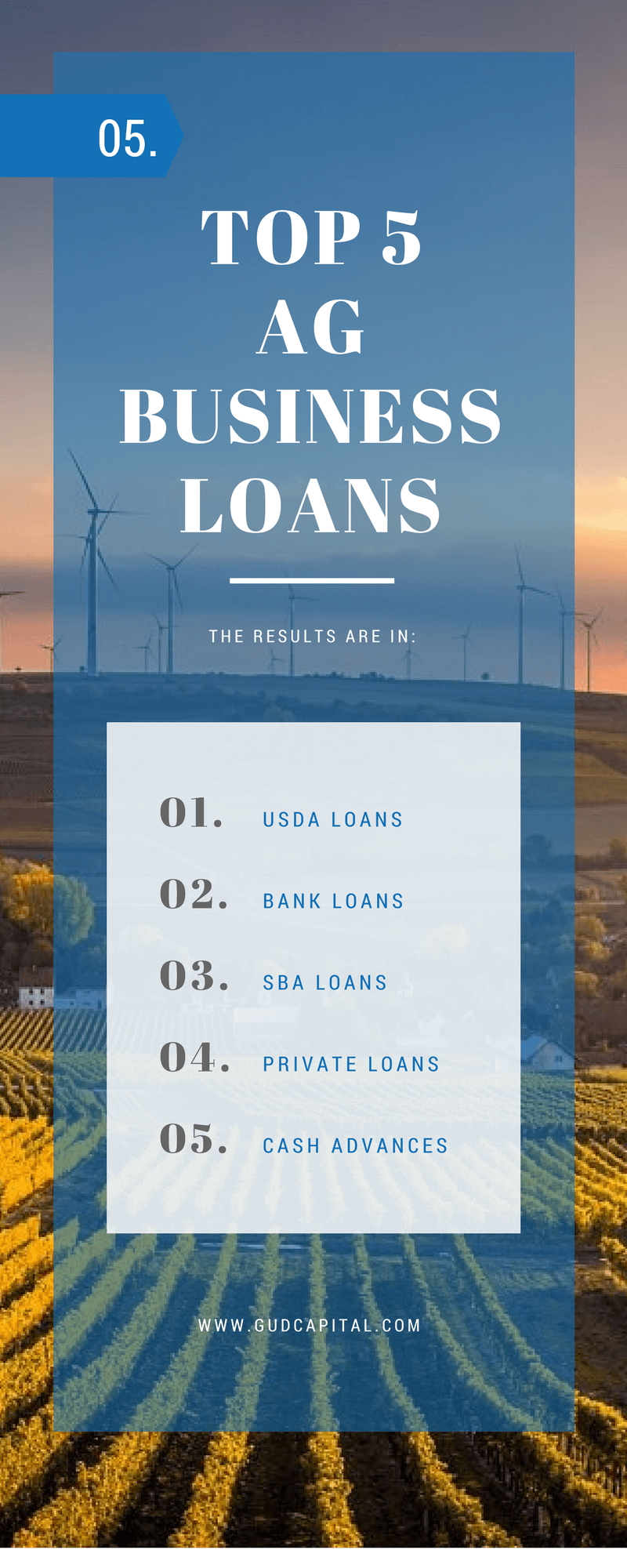

AgriBusiness Bank Loans

Bank loans are an exceptional financing option for ag businesses that have been established for a while, and have consistent revenues and profitability. Bank business loans are used to purchase land or real estate, refinance an agriculture business mortgage, purchase and upgrade machinary and equipment, as well as general working capital purposes.

AgroBusiness SBA Loans

SBA loans are another exceptional resource for agriculture businesses looking for quality, bank-rate business financing. SBA loans are fairly similar to conventional bank financing because SBA lenders are conventional lenders (large and small banks, community banks, credit unions). SBA loans are often used by ag businesses for purchasing businesses, refinancing business debt, obtaining working capital, and just about any use you can think of.

Agriculture Alternative Small Business Loans

With conventional banks having tightened credit requirements over the past decade, alternative lenders have filled the small business lending space offering companies affordable financing without many of the hassles conventional lenders require. Alternative business loans are great for agricultural businesses that don’t have the credit required by banks, don’t have the profitability that banks require of small businesses, or don’t want to wait for weeks, or months, to get funded by the bank.

Agriculture Business Cash Advances

Cash advances are a way for agribusinesses to tap into their future revenues to obtain financing almost immediately. Rather than waiting for weeks and months for future revenue to come in, a cash advance allows you to access that revenue by selling a portion of future earning to a cash advance lender at a discount. Unlike more conventional types of business funding, a cash advance can be funded even with bad credit.