Stacking Merchant Cash Advances

There are a ton of financing options available to small growing businesses (such as SBA loans, bank loans, alternative loans, fintech loans, etc). Almost every small business will seek out and get funded by some sort of loan (debt financing) at some point in time. Most small businesses opt for, and achieve in obtaining their financing from more conventional lenders like SBA lenders and bank lenders. After receiving financing from these lenders, a borrower may find that at some point they may need to obtain additional financing to help with business operations. When they need funding the small business may seek-out a cash advance to obtain subordinate financing behind their main bank loan or line of credit. Or maybe you’re a small business that already has a merchant cash advance, and need financing? In this article, we will discuss the options for small companies to obtain additional financing.

What is Loan Stacking?

Loan stacking is simply the process of obtaining a loan after you already have one in place. More commonly, loan stacking often refers to a company that already has a merchant cash advance in place obtaining a second position merchant cash advance on top of what they have. Loan stacking doesn’t just include obtaining a second advance, it could involve getting a third position or more (as its become increasingly common for companies to stack up to five or more advances on top of each other.

Why Would a Company Stack Cash Advances?

Most small businesses that stack cash advances on top of actual business loans like bank or SBA financing tend to do it because the bank wouldn’t provide them additional funding, the banks were unwilling to refinance their current loan or SBA financing, or because the small business is in needs of immediate funding and can’t wait for the banks underwriting to complete their processes. Additionally, a company may stack a cash advance if they have a current advance, but have an business opportunity that requires additional funds.

Types of Loans that Get Stacked By Cash Advances

- Bank Loans: while some companies that stack cash advances have traditional bank facilities already in place, the small business wants to make sure that obtaining the cash advance (and a possible UCC filing) may put your current bank loan in jeopardy, as it may violate an agreement.

- SBA Loans: as with a conventional or traditional business lender, if you have a SBA loan or SBA line of credit, obtaining additional funding may violate the covenants of your SBA financing agreement.

- Alternative Loans: Many mid prime alternative fintech lenders may find their loans being stacked by cash advances because there aren’t many options available for additional cash when you have marketplace loan other than cash advances. Alternative lenders rarely refinance or consolidate debt, leaving the small businesses with few other options.

- Equipment Leasing: Its very common to see a company that is leasing their business equipment or company machinery to have additional financing in place. In fact, many companies that lease equipment already have a bank loan or SBA loan in place. So in many cases, equipment that is financed by the business is often using financing that is stacking a senior facility.

- Cash Advances: Just because you have one business cash advance doesn’t mean its your only one. In fact, it seems that most businesses that obtain a merchant cash advance rarely ends up with just one, as they are easily obtained (provided your revenue and cash-flow shows that you can support additional payments.

Advantages of Stacking:

- Immediate financing: As many merchants with cash advances already know, you can get your cash advances funded quickly – with funds wired into the merchant’s account within a matter of days. In fact, some funding companies are able to approve and fund a small business who applies for a cash advance the very same day as the application is supplied.

- Easy to obtain: Most cash advance lenders don’t put much emphases on credit because they focus heavily on the business’s cash-flow, which makes it easy to get a business loan if you’re seeking a merchant cash advance with bad credit. In fact, there are many funding companies that are more than willing to fund a business owner with bad credit scores as low as 500. Even more, there are certain cash advance lenders (mostly MCA split lenders) that are willing to provide financing to a business no matter what their credit score is.

Disadvantages of Stacking:

- Stress on Cash-Flow: If you’re a business already making payments to your bank or SBA lender, you may already feel the stress of servicing the debt. Adding additional cash advance payments will only add more cash-flow stress, as a merchant cash advance relies on daily payments that are automatically deducted from your bank accounts each business day. As you stack advances, the rates become higher, and the terms become shorter, placing even greater stress on your working capital.

- Risk of Default: As your cash-flow becomes more and more constrained by cash advance payments, the risk of defaulting on both your loans and cash advances increases. Defaulting on your cash advance could lead to a UCC being filed and a judgement filed against the business, effectively shutting-down the company.

- Debt-trap: What often happens with a cash advance is the merchant will take the advance to take care of immediate financing needs without having a long-term strategy of how to service the cash advance – leading to the business taking-out another cash advance to help pay for the previous cash advance, creating a debt trap.

- Violation of Contracts and Agreements: As mentioned earlier, if you have a conventional bank loan or line of credit, or a SBA loan, if you take a cash advance (or any sort of debt financing facility) you may be in violation of the terms of the financing agreement they provided. If the lenders find out, they may demand full repayment of their loans immediately, putting the small business in an impossible position.

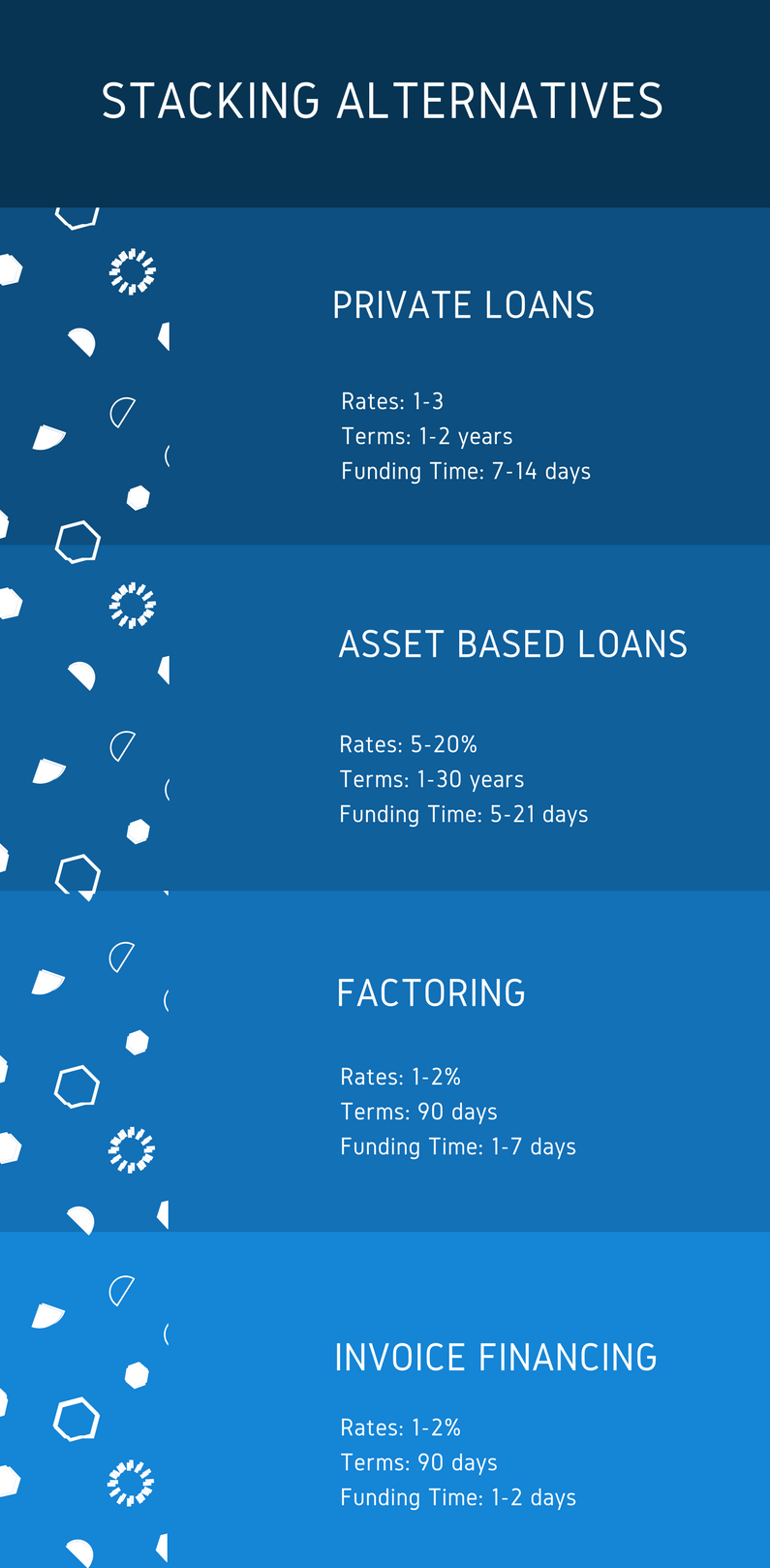

Alternative to Loan Stacking:

- Refinance Cash Advances: If you have a single advance and need additional funds, an option could be to refinance your current advance with a new advance. Most advance refinancing companies will require the borrower to have paid-back 50% of their current advance before they would consider refinancing.

- Consolidate Cash Advances: If you have two or more advances, another option would be to consolidate your advances into a single cash advance, so you will only have to make a single payment each day (or week if you have weekly payments).

- Lease Equipment: Rather than take out another cash advance to help buy or replace needed business equipment or machinery, another option could be to lease the equipment from an equipment leasing company to avoid the headaches of daily payments.

- Private Loans: Private lenders are willing to refinance and consolidate multiple cash advances if you have equity in business property that you would like to use for funding, of if you have net profits that are 150% of the amount you need consolidated.

- Invoice financing: Rather than stack an advance to get immediate funding to help with operations, another option could be to factor an invoice so you can access that cash early without having to take-out a loan.

Conclusion

Ideally, a company wouldn’t need to resort to obtaining a merchant cash advance to take care of their financing needs, let alone stack multiple advances together. As we’ve mentioned, stacking advances can put your business under great stress, as payments can be difficult to make at times. But if you need to obtain additional financing and are looking to stack your cash advances, please reach-out to one of our financing experts and we will help you navigate the funding process.