Nontraditional Business Funding

Conventional Business financing is the top choice for small business owners looking for working capital funding to help cover costs associated with their business operations. Data shows an overwhelming majority of small business owners look to banks, credit unions and nontraditional business lenders for financing. Why? Because conventional business lenders offer, by far, the lowest rates and cost-efficient financing among all of the business lenders. On top of offering the lowest rates, conventional business lenders offer the longest terms of all commercial lending options. By offering the longest repayments schedules available a small business will find it easier to repay their debt because the payments are spread out leaving them with a smaller monthly payment, which allows them to use the extra cash for other business uses. So, it’s understandable that a business owner would look to conventional financing first. But what happens if the bank turns your business down for conventional financing? What other options are there? In this article, we will look at alternative and non-conventional business funding options, and whether one may be a good fit for your company.

What is Alternative Business Funding?

Alternative business funding relates to all types of financing provided by non- bank, private, and institutional business lenders. During the 2008 financial recession, many bank and conventional business lenders stopped providing financing to companies because credit dried up. With banks unwilling to make short term loans among themselves, they were even more unlikely to take on any type of risk at all, and were intent on holding as much cash as possible to protect their own balance sheets. With the conventional small business lending markets completely dried up new types of commercial lender stepped in to fill the void in the market. These lenders didn’t completely fill the void in the bank-rate loan market, but did step in to provide affordable working capital financing to small businesses that need short-term business funding.

Advantages of Alternative Business Funding?

- Access: being able to access capital that isn’t provided by conventional lenders is a huge benefit of alternative business options. Conventional lenders such as large banks, small banks, community lenders, credit unions, SBA lenders and USDA lenders approve between 20-50% of their loan requests. Alternative business funding lenders, on the other hand, approve between 70-95% of small business funding applications.

- Speed: When it comes to the conventional lending approval and underwriting process it can extremely time consuming. Just getting an initial approval from a bank may take weeks, and the final funding could drag-on for months. When it comes to alternative business funding, the process can be completed quickly, with funding in a matter of a weeks, days, or even the same day.

- Ease: Traditional business lenders will require three years of tax returns, three years of financial statements, personal tax returns, personal financial statements, debt schedules, lists of collateral, etc.. But most alternative business funding options have few documentation and stipulation requirements. The most documents you’d have to produce to get approved for alternative business funding would be an application, a single year of tax returns, bank statements and a profit and loss statement. But, the paperwork required may be much less. With some alternative business lending options, all you’d need to submit is a credit application and the business’s main operating bank account statements.

Disadvantages of Alternative Business Funding?

- Higher Rates: As stated previously, no business lender is able to offer rates lower than conventional bank lenders. But, whereas bank-rate lenders have rates that start in the mid-single digits, alternative business funding will rarely have rates in the single digits. In fact, alternative business funding loans and advances usally have rates that start in the mid-teens (for the most creditworthy applicants) and can have rates that end up north of 100% APR.

- Shorter Terms: Bank lenders can offer terms that range up to 10 years for working capital purposes, and up to 30 years for commercial real estate purchases and mortgage refinancing. But when it comes to alternative business funding the terms will almost always be much shorter. Alternative funding for working capital purposes are rarely more than two years in term, and may be as short as just three or four months.

- Increased Fees: Conventional lenders almost always have the lowest fees when it comes to all commercial financing options. But when you get a loan or advance from an alternative business funder you can expect to see moderate to high fees. Some of these fees aren’t clearly discussed before the loan funding is completed, so you’ll want to read the fee schedule closely.

Alternative Business Funding Uses:

While alternative business funding can be used for just about any use, it probably wouldn’t make sense for a business owner to take our a very short-term loan for long-term uses. And being that alternative business lending options are shorter in term than bank-rate lending options, most alternative loans are used for working capital purposes. Other uses include:

- Expansion: companies that are looking to expand see an opportunity to scale their business and increase revenue and profits. But the process of expanding requires an initial capital injection to cover the costs of the expansion. For smaller scale expansions, most bank lenders will be unwilling to take much interest. But when it comes to alternative business funding, the options are plentiful, and the process is simple.

- Payroll: Companies in need of providing payroll to their employees don’t have the luxury of applying for a loan from their local bank, and waiting weeks and months for an approval and funding. When a company needs to make payroll, they have just days to complete funding. Alternative business funding is a way for small businesses to ensure that payroll is met, and their employees are happy.

- Advertising: Being able to market your product or services is key to making sure your company can grow. If consumers don’t know what your company has to offer, they won’t hire you or buy your product. Often, the costs of marketing and advertising are relatively small as compared to what most banks will see as far as business loan requests. But when it comes to smaller loan requests, alternative business funders are much more likely to take interest.

- Equipment: If your business relies on equipment and machinery for business operations, you know that you can’t afford to wait weeks for funding to complete should your equipment break and need immediate replacing. Alternative business funders are able to offer a variety of funding options to help companies get their equipment or machinery replaced immediately through loans, leases or advances.

Types of Alternative Business Funding?

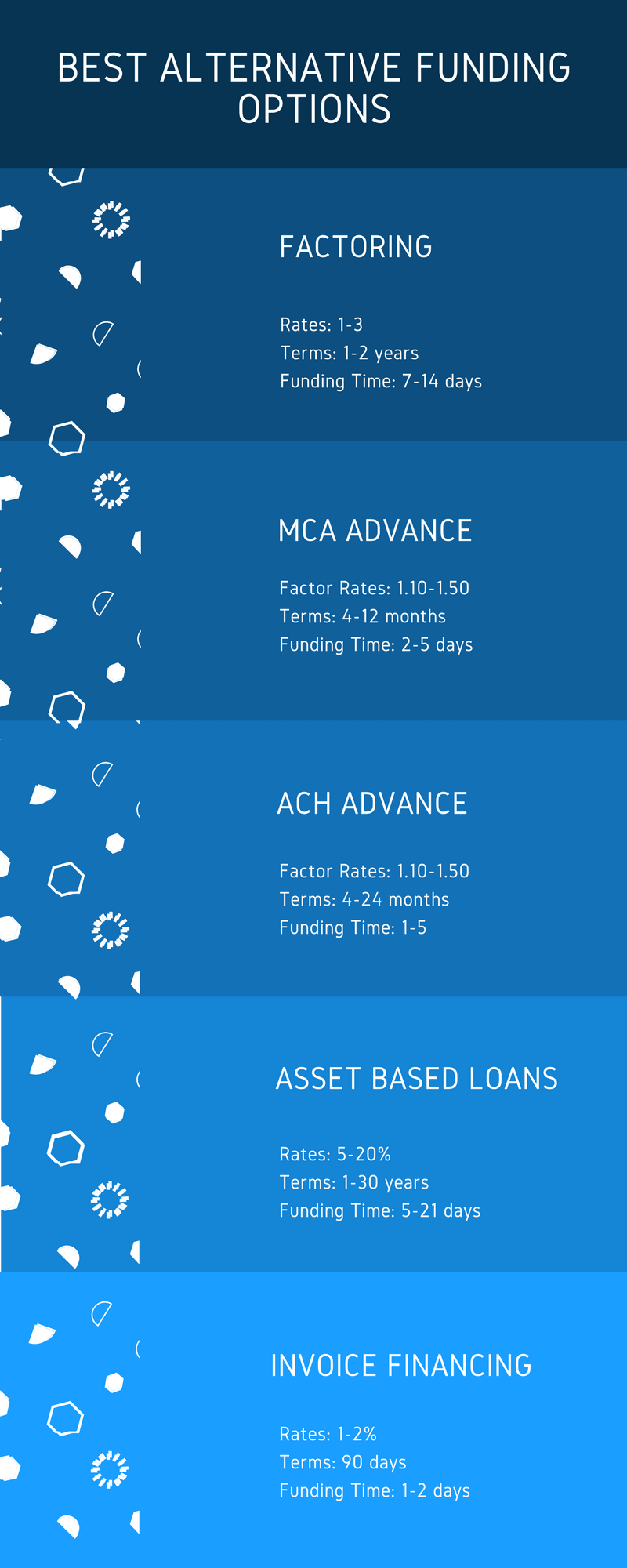

- Alternative Marketplace Funding: This type of financing is offered by mid prime lenders, fintech business funders and non-bank private lenders. Marketplace lenders offer financing products that are made to fill the gap between bank lending and the very high-interest merchant cash advances. These types of loans also tend to have the longest terms of all the alternative business funding options, with terms ranging up to 2 years.

- Alternative Equipment Financing: Not every business owner is looking to take-out a loan to purchase new or used business equipment. An alternative option would be to replace the equipment by leasing it. How leasing works is: an alternative lender will purchase the equipment for your company, and then lease it to you for a period of time (with an option to buy at the end of the lease).

- Alternative Invoice Funding: Rather than wait around for one of your clients to pay for your products or services, you can sell your unpaid 30-90 invoices to a 3rd party factoring company, and receive immediate funds. Of course, the funder will charge a fee, and hold back some of the invoice’s value, but you’ll receive the balance of the invoice’s value once the invoice is paid.

- ACH Merchant Funding: Merchant cash advances are becoming more popular among small businesses facing a cash-flow crunch and in need of immediate funding. Merchant cash advances can fund in a matter of days and, in some cases, can fund the very same day as when the merchant applies. An ACH advance is a merchant cash advance that is repaid using Automated Clearing House payments each day from the merchant’s bank account to the funder.

- MCA Merchant Split: this is a variation of a merchant or business cash advance. The main difference between a MCA split and an ACH cash advance is the repayment method. Whereas an ACH advance is repaid using the merchant’s bank account, a MCA split is repaid by splitting the merchant’s daily credit card sales with the funder until the funder is repaid.

Conclusion

There are dozens of alternative business funding options available provided by hundreds, if not thousands, of lenders and funders. Being able to differentiate the products may not be an easy task for someone who isn’t trained in commercial finance. If you are considering an alternative business funding options and need help navigating the process, please reach-out to one of our alternative business funding experts and they’ll help you get the best financing option available.