Growth Capital Funding Options

The goal of your small business, and every small business, is to take your smaller operation and grow your company into a giant. Nearly every small business sets out with dreams of turning their company into a source of income that will provide the business owners with financial stability and wealth, while also doing their part to creates good paying jobs for the United States economy. What small business owners find is that along the way to Fortune 500 status there are a lot of growing pains. Along with the growing pains is also the ability for small businesses to access capital to help with their growth. In fact, having easily accessible and affordable capital may be the difference between taking your company’s growth to the next level, and being stuck in a rut of mediocrity. In this article, we will look at the small business growth capital options, and ways for your small business to access top-quality capital.

What is Growth Capital

Quite simply, growth capital is money your business borrows to help grow their business’s operations and, hopefully, the overall profitably of the company. Growth capital comes in many different forms, structures, and rates, so there are many options. Some growth capital is structured as term loans, while other lenders will structure their growth capital options as lines of credit. Naturally we think of growth capital as being long-term financing, and that is usually the case. Most growth capital lending options are usually long-term because of the ease of repayment. But growth capital loans may be structured as a short-term business loan if it makes sense to take advantage of an opportunity.

How is Growth Capital Different than Working Capital?

While they may have some similarities, business growth capital and working capital are not the same. As mentioned previously, growth capital relates to loans and debt financing taken to help a business with their growth plans. So, essentially, these are loans and advances by existing companies that are looking to take advantage of opportunities to grow. Working capital, on the other hand, relates to business financing used to help the company with day-to-day financing of the business operations. So, this type is capital isn’t necessarily used to grow, but to bridge and maintain current operations.

Difference Between Debt Growth Capital and Equity Capital?

There are major differences between business Growth capital that comes as a form of debt, and equity growth capital. Equity capital requires giving up a portion of ownership in exchange for the growth funding. While you may give up some equity in your company, you usually receive not only funding, but also a strategic relationship with the investor providing the equity (as it’s in the investor’s interest to maximize the company’s growth and profits). Debt growth capital on the other hand doesn’t require giving up any ownership or equity in the company in exchange for funding. Therefore, debt growth capital are structured as loans or cash advances.

What Do Growth Capital Lenders Look for in Applicants?

When a company applies for a growth capital loan, it’s important to understand what the lenders look for so that you’ll know what requirements to meet. With more conventional growth capital lenders, they’ll generally look to see if a company is profitable, or near profitability. The lender wants to make sure that your business model is a proven one, and that your company has worked out efficiencies before providing you with financing to help you grow. After all, while your goal is to grow your company, the growth capital lender’s goal is to be paid-back. The best way for a lender to increase their chances of being paid-back is to lend to companies showing existing cash-flow is sufficient to service the new debt.

Growth Capital Uses:

- Purchase Commercial Real Estate: One of the most common ways a company seeks to grow is to purchase their owner-user commercial property that their company uses for its operations. By purchasing and obtaining a commercial real estate loan, you may be able to reduce your monthly payments substantially.

- Purchase Equipment: For many companies, the attempt to grow will requiring ramping up production. To increase production, what is often needed is for the small business to purchase or lease business equipment so they can keep up with demand.

- Add Employees: Increasing production will often require increasing your company’s workforce to meet any new demand you’ll create from your expansion. While equipment and machinery are generally vital for company growth, and the end of the day, additional employees will probably be needed.

- Enter New Market: Let’s say you have an established location that is cash-flowing, and you see an opportunity to branch-out into a new market by opening a new location, or providing services within a new area. Having quality growth capital is what could make this expansion happen, and a missed growth opportunity.

- Increase Advertising and Marketing: So now that you’ve decided on a growth plan, you’ve probably included a new or increased marketing strategy to help you reach the maximum targeted market for your goods or supplies.

- Acquire Another Company: Sometimes part of growing involves acquiring an established business in your field, to incorporate into your own company. Having systems and employees in place that can blend with your current business operations may help take your company to the next level with growing.

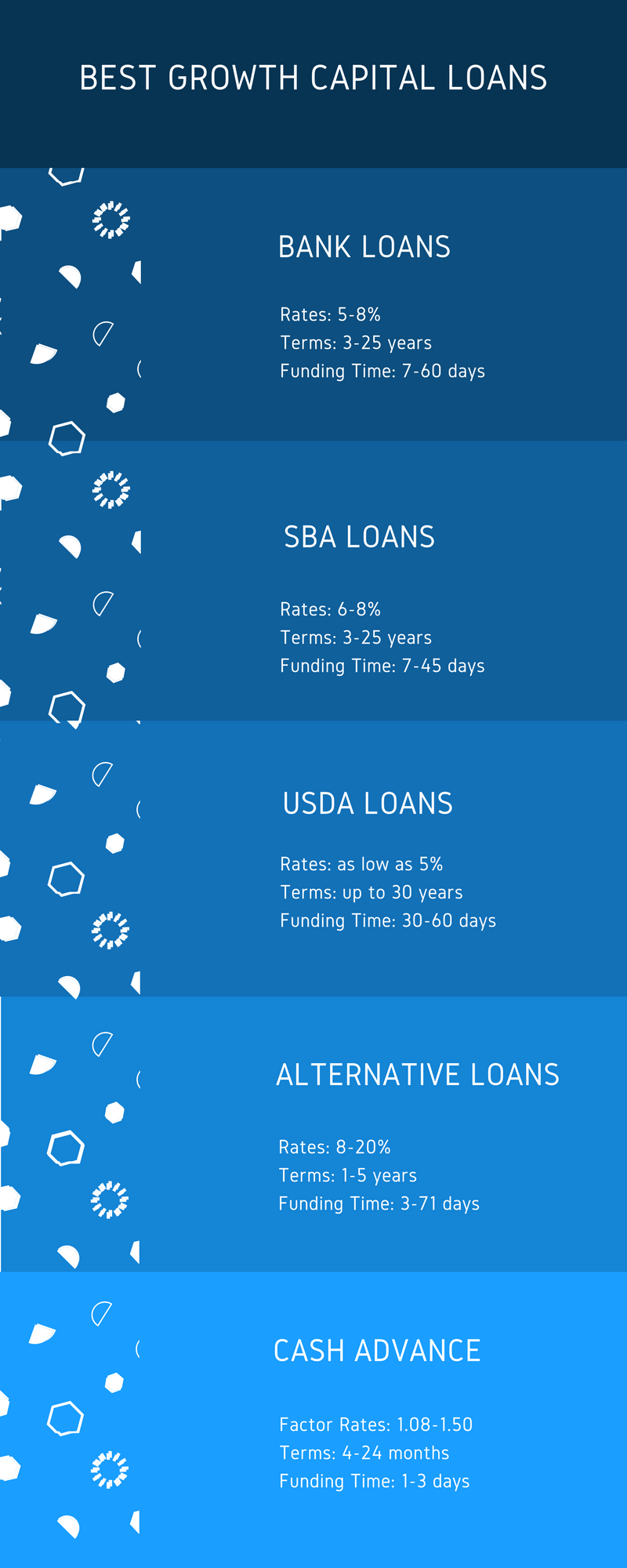

Types of Growth Capital Loans:

- Conventional Growth Capital: When it comes to obtain the top-quality business financing, nothing is better than getting financing from a bank. Bank lenders (large banks, smaller banks, credit unions. Non-profit lenders, community banks) have the lowest rates, longest terms, and lowest fees of any type of growth financing available. Banks offer both term loans and lines of credit (or both) to companies looking to longer-amortizing loans. Common uses of bank loans include: purchase of real estate, real estate mortgages, debt refinancing and consolidation, equipment and machinery purchases, and general working capital purposes.

- SBA Growth Capital: Essentially, SBA financing is just a bank loan with an enhancement (which is a guarantee by the Small Business Administration to cover some or most of the lender’s losses should the borrower fail to repay their growth capital loans or line of credit. SBA loans come as both term loans and lines of credit, and are commonly used for startup financing, business acquisitions, financing of expansion and construction of facilities, revolving funds and working capital.

- Asset Based Growth Capital: Bank lenders are going to need to see both collateral and substantial cash-flow to get approved for financing. For companies that may not have strong enough cash-flow to get financed by a bank-rate lender, another option could be to use your commercial real estate, personal real estate, equipment and machinery or inventory as collateral to obtain financing. Asset based lending rates are higher than banks, and the terms are shorter than conventional lenders offer, but it may be the only option available for companies in need of cash for growth.

- Alternative Growth Capital: As mentioned, not every bank lender is going to approve a business for a loan. In fact, the average conventional business lender only approves between 20-50% of growth capital loans. Thankfully, there are other affordable options for a company looking to grow, including alternative lending options like non-bank lenders, private lenders, marketplace lenders and mid-prime alternative lenders. While these loans are shorter than the loan bank offer, they still can be amortized over as many as five years.

- Cash Advance Capital: Generally used for short term purposes, a cash advance used for growth capital involves selling a portion of your company’s future receivables (either business bank account receivables, or merchant processing account receivables) in exchange for a lump sum paid upfront. But keep in mind that merchant cash advances are some of the most expensive forms of business financing available, so the use-of-funds should be able to increase revenue by more than the cost of financing to make sense.

Summary

As you can see, there are many financing options for small businesses looking to grow their companies into large businesses. Ideally, we’d all like to start with getting a loan from a bank, but its not always that easy. You should absolutely start with the healthiest financing options first, and then work down from there until you find the best possible growth financing for your business. If you need help learning about all the growth capital options and need help navigating the funding process, please reach-out to one of our growth capital experts, and they’ll help you obtain the best possible growth capital funding option available.