Business Bridge Funding

Your company has a financial obligation it needs to take care of, but doesn’t have the time to wait around a month or more to get funded. What is a company to do to get the financing they need, right now, to cover their obligations? A bridge loan.

What is a Business Bridge Loan?

A bridge loan isn’t really a specific type of business loan, but rather reflects the use of the loan. Small business owners use bridge loans to bridge their financial obligations. These financial obligations vary, as some bridge loans are used to bridge financial obligations related to commercial real estate. Many commercial property owners will find themselves with a balloon mortgage or hard money loan that is about to mature, and may seek funds cover their costs until permanent financing takes place. Other bridge loans don’t involve commercial property at all but are, instead, used to help bridge their working capital needs. Sometimes a business may be waiting for a permanent loan to fund, but a more common type of bridge financing use is to help bridge payments by customers.

How Do Bridge Loans Differ from Other Loans?

Bridge loans only really differ from other types of commercial financing in that they are short-term and temporary. Bridge loans are, by definition, a temporary type of financing. These loans are usually paid-back within 1-12 months, and have higher rates than other business financing options. Bridge loans may pose more risk to the lenders, which is why the rates, fees and overall cost of financing is higher than conventional forms of financing, but they require less paperwork and credit requirements than the traditional loans require.

Are Bridge Loans Secured or Unsecured?

Both. Some bridge lenders will require their bridge loans to be secured by hard assets or personal assets. Commercial real estate bridge lenders will use the actual real estate as collateralized secured business loans. Other lenders will secure the loan using the business’s equipment and machinery. There are other types of lenders that will secure the loan using accounts receivables and unpaid invoices. With that having been said, an unsecured business lender won’t need any actual collateral to provide financing. That doesn’t mean the business will be off-the-hook should they default, as most unsecured business lenders will still file a UCC lien on a business when they provide a loan to ensure they have some recourse to recoup funds.

How Long Does it Take to get a Bridge Loan?

Depends. There are many varieties of bridge lenders – each providing different types of bridge loans for different uses and with different collateral requirements. With that having been said, bridge loans almost always fund faster than a permeant conventional business loan. A commercial real estate bridge loan may fund in the matter of days to weeks. A working capital bridge loan tends to fund much faster, with funds hitting the business’s accounts in less than a week.

Why do Bridge Loans Have Higher Rates Than Regular Loans?

Bridge loans have an expedited underwriting and due diligence process needed to speed-up funding to help the business owners cover their needs. Since there is less due diligence, the lender is taking more risk, because they aren’t able to vet the business and its owners as thoroughly as conventional lenders usually require. Because the process is shortened, with less financial documentation required, the lender is exposing themselves to increased risk. When the risk to the lender is increased, the cost of financing is also increased – thus: leaving the borrower with a higher cost of borrowing.

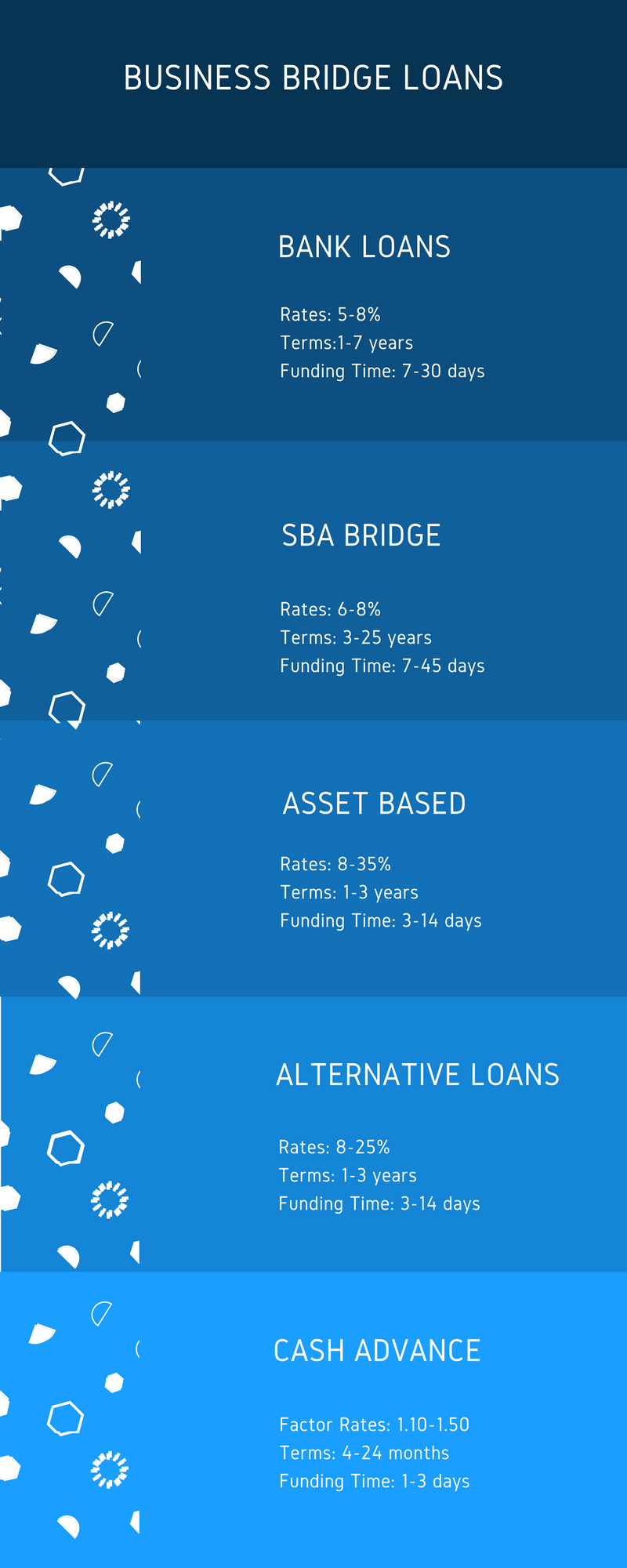

What are the Bridge Funding Options?

- SBA Bridge Loans: When a business owner is awaiting permanent SBA financing to be put into place, they may seek a short-term financing options to help take care of some working capital needs. SBA bridge loans are used with both SBA 7(a) loans, and SBA 504 loans, and can be used for general working capital purposes, or to bridge a commercial real estate loan. Small businesses that choose to use a SBA bridge loan should be careful, though, because if you get the wrong type of financing, you could find yourself ineligible for a SBA loan. Borrowers who use a merchant cash advance to bridge their needs could find their SBA loan request denied because they deem that sort of debt ineligible to refinance because of the excessive rates.

- Commercial Real Estate Bridge Loans: When a borrower is looking to refinance their current loan (whether it be a hard money loan they’re looking to refinance, a commercial balloon mortgage refinance, or just a conventional refinancing) they may look to obtain financing to buy-out their current mortgage, and put in place a short-term mortgage until lower-rate financing is put in place. When a borrower gets a bridge loan on commercial real estate, they are using that commercial property as collateral to obtain financing. Commercial real estate bridge loans may also be used by business owners looking for short term working capital. These types of loans have lower rates and longer terms than alternative loans and cash advances, because the lender has some recourse to recoup some losses if the borrower defaults on their loan.

- Bank Loans: Always a preferred type of business financing, a bank loan offers borrowers with the lowest cost of capital of any option. Bank business lenders have substantial capital behind them, and can lend an almost limitless amount of cash to creditworthy small businesses (provided their financials can support the loan repayments). But the key word here is “creditworthy”. Bank lenders will only lend to the businesses and business owners with the best credit, and who can also provide adequate collateral. Additionally, bank lenders will want to make sure your financials are exceptional, and they can do it because they only choose the best applicants to fund, as they only approve between 20-50% of their loans (depending on if they are large banks, small banks or community banks and credit unions). With that having been said, banks don’t generally offer many bridge loan options to small businesses.

- Alternative Loans: This is becoming a more common type of financing for small businesses seeking bridge financing for both real estate and working capital. Many commercial real estate owners use alternative loans to obtain bridge financing (a type of financing that conventional lenders won’t originate). A common type of alternative commercial real estate loan is a hard money loan, which is a type of short term loan used by commercial property owners for bridging purposes. When it comes to bridge lending for working capital purposes, alternative loans offer an affordable type of business financing for company’s that are unable to get approved by banks and other convention lenders.

- Asset Based Loans: monetizing your business’s balance sheets could be a way to obtain creative yet affordable financing. Asset based bridge lenders will use a number of types of assets to use as collateral, including your company’s accounts receivables, your business or personal real estate, your company’s inventory, or the business’s equipment and machinery. The most common type of asset based bridge financing involves providing lines of credit collateralized by the company’s AR, or factoring the company’s invoices. But asset based loans using commercial real estate is becoming more common these days for businesses looking to bridge gaps in financing.

- Merchant Cash Advance: While a MCA may be very expensive, there are times a cash advance can be useful and needed to bridge financial obligations. While merchant cash advances are not loans (they are a type of funding that involves selling the company’s future receivables to a funding company at a discount) they are a way to obtain fast bridge financing with minimal paperwork and credit requirements. The process of obtaining a merchant cash advance usually only requires an application and supplying business bank statements to get approved. Once approved the funding company may request additional documents, but not nearly as many documents needed to obtain other types of financing. The process takes just days, with most merchant cash advances funded in 1-3 days (sometimes even the same day).

Conclusion

As you can see there are plenty of bridge financing options to small businesses seeking help with covering their financial obligations. Making sure you’re getting the right bridge loan requires doing your research, and possibly applying with multiple lenders to ensure you get the lowest rates and cost of financing. If you need help obtaining the best possible bridge loan for your business, please feel free to reach-out to one of our bridge loan experts, and we’ll help you navigate the process.

[wp-review id=”84675″]