Business Financing to Pay Taxes

Let’s talk about taxes. I know – it is the part of running a company that any business owner, both new business owners and well-established business owners, dread. But why is this? There are a variety of complicated tax requirements, codes, rules, and obligations that vary based on many factors. What type of business is your business classified as? Do you have employees? Does sales tax apply to your business? Are you selling goods or services? What are your local state and city tax requirements? The questions are endless. In the end, there are two major distinctions for deciding how to file your business taxes: filing taxes for small businesses, which is further broken down into subcategories, and corporate business taxes.

Based on these two basic classifications, we can start to break down the tax system for each type of business while ensuring that all business owners have a basic understanding of their business’s tax requirements and obligations. However, many business owners will still opt to hire an accountant, which is never a bad idea! While we can provide a brief outline of important tax components, having a trustworthy accountant on hand can always help for more personalized business tax concerns and questions.

Understanding Taxes for Small Businesses:

Small businesses are vital to the United States economy, but many new and first-time business owners are overwhelmed with the confusion associated with taxes – and rightfully so! There are many different considerations for small businesses that must be identified before understanding which tax codes are applicable to your small business.

For starters, if you are starting or currently running a small business, you need to understand how your business structure, or how you have legally structured your business, affects your tax requirements and obligations. Whether you are a Sole Proprietor, Partnership, or Limited Liability Company (LLC), there are a variety of tax commitments that require plenty of working knowledge on the subject of taxes (all of which is outlined in more depth in the links provided). Then, once you understand the inner workings of taxes for your specific business structure, you must obtain an Employer Identification Number (EIN) – this is essentially your social security number for your business. Unless you run a sole proprietorship business structure, then you need an Employer Identification Number.

After setting up business structures and an Employer Identification Number, there are five basic taxes that every small business must understand:

- 1) Income Tax: All businesses, except for partnerships, file annual income tax returns. Partnerships file an information return; once again, this is determined by how your business is legally structured. In regards to federal income tax, business owners have to “pay as you go”, which means that you, as the business owner, must pay your business income taxes as you earn and/or receive income throughout the year. While an employee will often have their income tax withheld in each paycheck (referred to as “withholding”), this is not always the case, which means you will often have to pay an estimated tax.

- 2) Estimated Tax: While estimated tax is often utilized when an employer is not withholding income taxes from their employee’s paychecks or if the withheld amount was not enough, there are also a few other reasons why estimated taxes will be relevant to your business. Sometimes receiving alternative incomes (such as dividends, alimony, self-employment profits, and so forth) will also warrant the use of estimated tax payments. According to the Internal Revenue Service (IRS), if you had no tax liability the previous year, were a United States citizen for the past year, and the previous tax year was at least twelve months long, you do not have to pay estimated taxes. Estimated tax is incredibly common for self-employed businesses.

- 3) Self-Employment Tax: Self-employment tax, otherwise referred to as SE tax, is a tax that ensures social security and Medicare benefits. If your self-employed business has net earnings over $400, you will be required to filed SE taxes. The benefits of Self-Employment taxes include the benefits of social security which include: retirement benefits, disability benefits, survivor benefits, and hospital insurance.

- 4) Employment Tax: If you have employees, you have to pay: social security, Medicare, federal income tax withholding, and federal unemployment tax (FUTA). This particular tax is applicable to many small business owners, so understanding the complexities of this tax, or utilizing financing options to hire outside accountant support, are vital to the success of any small business.

- 5) Excise Tax: Excise taxes are applicable in certain unique situations, which typically revolve around the industry you operate in. For example, if you manufacture or sell certain products, operate specific kinds of businesses, utilize particular pieces of equipment or facilities, and so forth, you probably have to become familiar with the excise tax.

Understanding Corporate Business Taxes:

Understanding the complexities of filing taxes, for small businesses or for corporations, can be confusing. Even reading brief outlines of the tax system will overwhelm even the most seasoned business owner. In the end, making sure to understand and adapt to the tax system can be vital to success in owning and operating a business.

Small businesses make up a majority of businesses throughout the United States, but there are still plenty of tax regulations and complications associated with owning and operating a corporation. One of the first distinguishing factors in relation to taxes and corporations include deterimining the business structure of the corporation. The two options to classify a business structure under for corporations include C-Corps and S-Corps.

However, in general, corporation shareholders commonly exchange money and/or property for capital stock, which allows corporations to utilize sole proprietorship tax laws, including various special deductions. A distinguishing factor between business structure tax differences for corporations appear when you identify as a C-corp. C corporations are technically a separate entity, which enforces that C corporations follow similar federal income tax procedures as small businesses. Ultimately, corporations have many similar income tax, estimated tax, and employment taxes as small businesses, with unique caveats for each business structure.

In the end, all businesses are dealing with complicated, confusing, but unavoidable tax structures. By working with accountants and tax professionals in the field, business owners can further understand the vital tax system that is an unavoidable part of owning a successful company.

Types of Business Loans to Pay Taxes

Business owners in need of loans to pay taxes, will seek financing because they have a tax bill that needs to be paid soon, or a late tax bill that has resulted in a business tax lien. If you haven’t had the IRS place a lien against your company because of unpaid taxes, your tax funding options are numerous. But if you already have a tax lien, the options narrow.

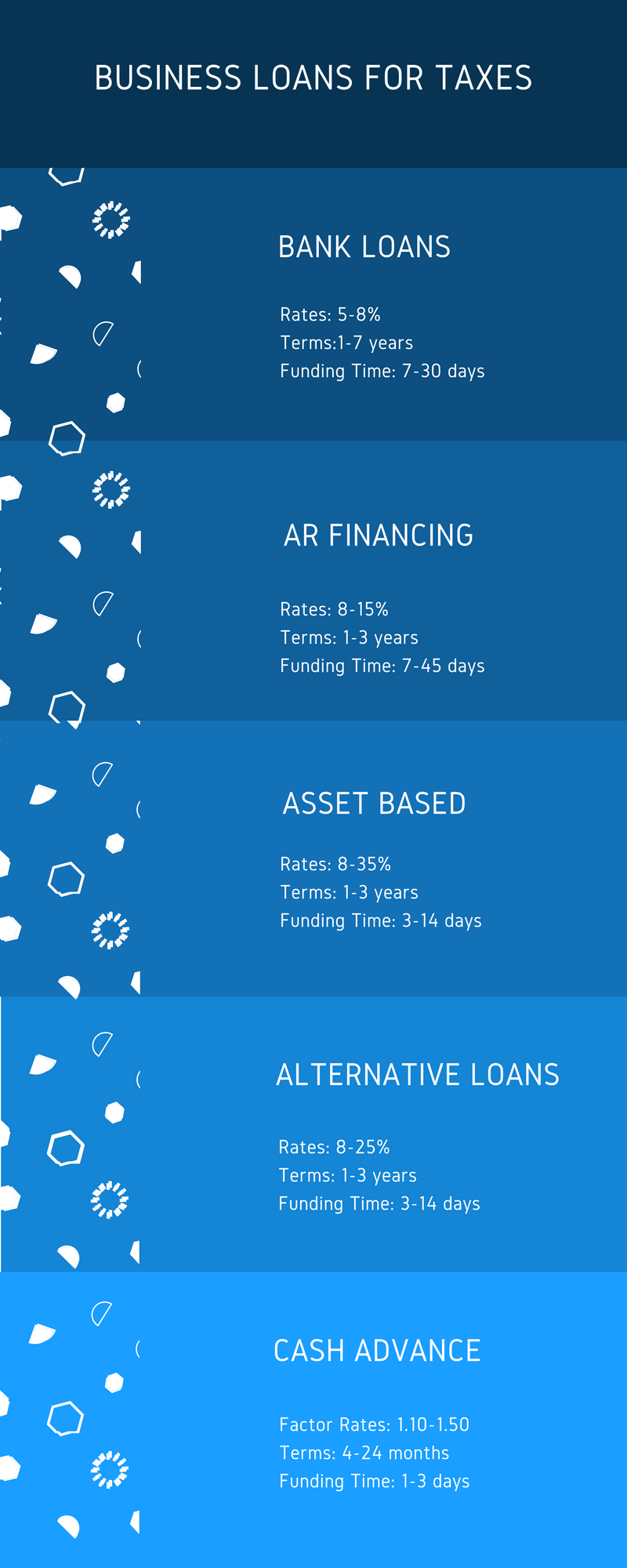

- Bank Loans: If you owe taxes but haven’t yet had a lien placed against your business, getting a conventional business loan from a bank is definitely the best option. Why? Because the rates and terms are the best available among all the commercial lending options.

- Alternative Loans: There are many alternative lending options for small businesses in need of paying their current or late tax bill. Alternative loans are loans provided by non-bank lenders, such as alternative lending marketplaces, fintech alternative lenders, mid-prime business lenders and private investors. While the rates and terms associated with alternative business lending are higher than bank loans, many of these lending options are much better than cash advances.

- Factoring: Small business owners who have solid accounts receivables and also have tax bills could sell their AR to factoring companies and use the proceeds to pay their tax bill. By factoring their invoices, the borrower will pay a much lower rate than they would find if they sell their future receivables to a merchant cash advance funding company.

- AR Financing: This type of alternative business financing involves using your company’s accounts receivables as collateral to obtain a line of credit. This type of business financing differs from factoring, because factoring involves the actual sale of the AR.

- Cash Advances: A merchant cash advance for paying off tax liens or to pay tax bills involves selling the company’s future receivables to a cash advance company to obtain a lump sum of cash. Business cash advances are high-rate, high-rate financing, with fast approvals and quick funding.

- Asset Based Loans: Using your company’s or personal assets is another way a company can pay their tax bills or remove their tax liens. A popular way to obtain asset based financing is to use your company’s real estate (or personal and investment real estate) to obtain a new mortgage and cash-out some of the property’s equity to obtain financing.