Pet Grooming Business Funding

We are now living in a time where animals are no longer, well, animals. As many of you are reading this, you are thinking of your beloved pet that you probably spoil more than your children – and that is the societal norm today. Believe me, my mother wanted to keep the cats when the kids left home, but did not really object to us leaving! In the end, the reality is that we all love our furry friends, and the industry trends of the entire pet retail and service industries are reflecting this.

As of 2015, 65 percent of households in the United States own at least one pet, and this number is consistently growing. Even in lower income households, people are acquiring more pets and pampering them. Part of this is due to wanting our new members of the household to feel loved and treated well, but the pampering of pets is also in part due to the feelings of the pet owner. After all, does anyone really need to buy an $80 name brand sweater for their dog or cat? Probably not. However, this is a major contributor to the growing pet service market.

One of the top growing industries within the pet care market is pet grooming services. Reviewing year after year profits for the pet grooming sector, it is obvious that this niche area shows no signs of slowing down. From 2006 to 2007, there was an increase in profits for the pet grooming industry from $2.7 billion to $2.9 billion. By 2016, pet services, including pet grooming and pet boarding, reached $5.76 billion in revenues. Now, there is an estimated $6.11 billion in profits for pet grooming and other services by the end of 2017. These numbers are astonishing for such a niche industry, which has led to an optimistic mindset for pet groomers everywhere for the future of pet grooming.

Pet Grooming Industry Trends

While the pet grooming sector will continue to see gains throughout the next few years, and plenty of financial gains within this year alone, there are many areas to pet grooming that have created an incredibly competitive landscape. While it would make sense that pet grooming would encompass basic cleaning, trimming, hair cutting, and nail clipping procedures, many pet groomers are finding that pet grooming is their answer to a financially successfully creative outlet. Today, there are even competitions throughout the United States that offer cash prizes for the most creatively (and safely) dyed and crafted animals. Ultimately, there are so many different venues that dog grooming can encompass – especially if you are trying to cater to elite, unique, and highly demanded services. Some of the current trends that all pet groomers should be focusing on today include:

- Mobile Pet Grooming versus Conventional Pet Grooming: Many consumers still favor conventional pet grooming – this includes calling a pet grooming business, scheduling an appointment, dropping your beloved animal at the pet groomer’s business, and picking them up when they are fully groomed and pampered. This is still a favorable option for many consumers because it is slightly more cost effective, conventional pet grooming facilities often have more scheduling availability, and it allows the pet owner to have some free time without the hassle of watching their pets (such as taking a child to daycare). However, many creative pet groomers are trying to appeal to a niche market with mobile pet grooming services. For example, many elderly people with companion animals have difficulties getting their pets, and themselves, to and from a pet grooming brick and mortar business. Mobile pet groomers eliminate this hassle and come straight to the client’s home. In addition to catering to people who either cannot make it to the pet grooming business, or for people that simply do not have time to do this, mobile pet groomers are catering to animals who fear grooming. This is incredibly common and can often lead to emotional distress in the animal. Mobile pet grooming allows the pet to feel safe because they are at their own homes where they are comfortable while being groomed.

- Animal Spa Treatments: This is another major area that is in high demand. People want their animals to be treated with compassion and love, as if they were a part of the family – which they are! In response to this demand, many pet grooming business owners are offering unique, but expensive, spa treatment options of their pets. This may seem silly to some people who cannot afford these extra expenses, but there is a huge, growing market for animal spa days! While there are upfront costs associated with implementing new products and services into a pet grooming business, there are many financing options to help with this!

- Environmentally Friendly, Green, and Chemical Free Products: As the eco-friendly movement continues to grow throughout the world, people are also demanding these products for their pets. Whether this is chemical free shampoos, environmentally friendly detergents for their dog, or healthy, safe ingredients in animal foods, there are plenty of options for animal groomers to partake in this trend. This green trend is greatly affecting every single industry throughout the world. As more consumers demand these products for themselves and their pets, the higher profits pet grooming business owners will see by offering these products.

- Self-Serve Animal Washing Stations: While pet groomers and pet grooming business owners make more profits from providing the animal grooming services themselves, there is a high demand in recent years for self-serve animal washing options. Sometimes, pets just need a quick bath between grooming appointments, or maybe the pet owner simply does not have the money to allow their pets to get a full grooming experience. Either way, there is financial incentive, and overall consumer benefits, to offering a few self-service animal washing tubs at your pet grooming facility. Not only is this a financial savvy, it also creates interactions, potential customer-business owner bonds, and keeps consumers coming back to your business. Giving consumers options are never a bad decision as it keeps all parties involved happy!

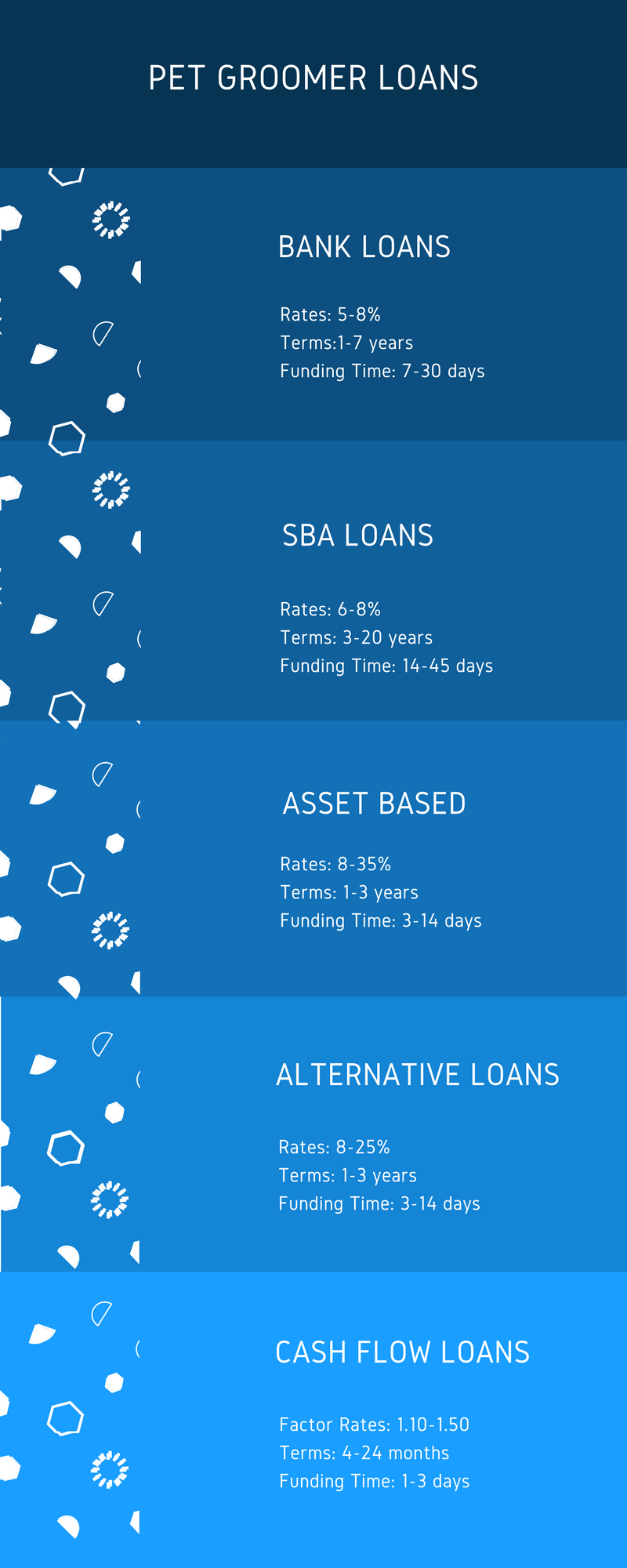

Options to Finance a Pet Grooming Business

- 1) SBA loans: loans offered through that Small Business Administration’s loan program are a great type of financing for new and growing businesses that are seeking bank-rate loans, but have been unable to get approved for financing. The SBA doesn’t actually lend money to small businesses, but instead offers a guarantee program to banks that are willing to participate in the program. If a bank decides to approve a loan using the SBA enhancement, the government will cover most of their losses should the SBA borrower default on their loan. By offering this guarantee it should, in theory, encourage more lenders to provide financing to small businesses.

- 2) Bank Loans: Business loans offered by banks (large banks, small banks, and community lenders) are clearly the best type of financing for business and commercial uses. Banks don’t approve many applicants (with only 2 in 5 being approved) because they don’t have an appetite for risk. But because of their lower-risk standards, they aren’t taking many losses – which leads to lower rates for the borrower. Banks offer multiple types of credit facilities, including term loans, lines of credit and equipment financing.

- 3) Alternative Loans: Non-traditional business loans are becoming more common as bank lenders step back from small business lending. Alternative loans relate to any financing facility that isn’t originated by a bank – including marketplace loans, fintech business lending, private business lending and mid-prime alternative lending. Alternative loans for pet groomers don’t have rates that are as low as a bank would offer, but many of the alternative business lending options are very affordable, and much easier to get approved than with a bank lender.

- 4) Asset Based Loans: Using your pet grooming company’s assets on your balance sheet is another way to obtain financing should you find yourself unable to get a loan using your company’s cash-flow or revenue. Lenders may be willing to provide funding for your company if you are able to show that you have sufficient assets to collateralize the loan. Common types of assets used for an ABL include: Business real estate, accounts receivables, equipment & machinery, and inventory. With that having been said, there are some lenders that will use you’re the owner of the pet grooming business’s personal assets as collateral. Such assets include personal real estate, investment real estate, and even land.

- 5) Cash Flow Funding: The most common type of financing used by pet groomers to increase their immediate cash-flow is through the use of merchant cash advances. A MCA isn’t a loan to the pet grooming business, but is the sale of the pet groomer’s future receivables to a funding company at a discount. There are two types of merchant cash advances: ACH funding and MCA split funding. They both have the same general structure, but the only difference is how the cash advance is repaid. With an ACH advance, the funder is repaid by collecting a set amount each business day directly from the pet grooming business’s bank accounts. A MCA split is repaid by having the funder collect a percentage of the pet grooming business’s credit card sales.