Alternative Loans For Bad Credit

As you may already have learned, getting a business loan from a conventional lender is tough enough as it is. But if you’re a business owner that has taken a hit to their credit, getting a traditional business loan is impossible. Banks will approve very few of their loans – and that’s only to the most creditworthy borrowers. So if you’re a business owner with bad credit, are there any lending options to help with purchasing real estate, buying inventory, working capital, etc.. In this article, we will look at a variety of lending options for businesses with poor credit.

What are Alternative Business Lenders?

Alternative business lenders are non-bank financing companies that offer nontraditional financing options to small businesses that are unable to get approved for financing from banks and other conventional lenders. While some alternative lenders have been around for decades, a large percentage of Alternative business lenders didn’t hit the scene until after the 2008-2009 Great Recession. During that crisis, the U.S. economy essentially hit a sudden stop, which caused lending to come to a halt, as banks stopped lending to each other. Even as the economy began recovering, conventional small business lending remained at a standstill. It was at that time that alternative lenders began stepping into the small business lending space, filling the gaps left by traditional lenders tightening up their credit and underwriting processes.

How do Alternative Business Lenders Differ from Conventional Lenders?

Whereas a conventional bank or credit union focus on a number of banking programs, an alternative business lender’s sole focus is on providing financing to small businesses and commercial investors. Alternative business lenders don’t offer checking and savings accounts, not do they handle investments and financial planning. The only products a nontraditional commercial lender will offer are loans, factoring and advances. With that having been said, conventional lenders always offer the lowest cost of financing than any commercial financing company or lenders. Banks can offer lower rates and longer terms because they don’t expose themselves to much risk. Alternative lenders, on the other hand, are willing to take risks conventional lenders won’t. In fact, some alternative lenders are willing to take substantial risks, approving loans to up to 95% of applicants.

What are the Advantages of Alternative Business Lending?

- Fast Approvals: A big advantage of bad credit alternative business lending is how quickly the lenders can approve a small business for a loan. While a bank may take weeks or even months to approve, an alternative lender can approve a loan in days if not hours.

- Fast Funding: After getting approved for a bad credit alternative loan, there is still a due diligence and underwriting process that the lender will undertake before funding the small business. With a bank loan this process will still take weeks to complete. Whereas with an alternative business loan the funding process may take days, hours or even minutes to complete after providing an approval offer.

- Lower Credit Requirements: If a borrower seeks financing from a bank, you really need to have a credit score above 700. But when it comes to alternative lending, just about any credit score can get approved for some type of financing — even small business owners with bad credit. In fact, some alternative financing companies will provide financing for small business owners with very bad credit.

- Less Documentation: when you apply with a bank for a small business loan, you can expect extensive documentation requirements including tax returns, debt schedules, income statements, balance sheets, etc. but when a business owner seeks a bad credit alternative loan, the amount of documentation required is much less. In fact, some alternative lenders may require as few documents as an application and bank statements.

What are the Disadvantages of Alternative Business Loans?

- Higher Rates: bad credit alternative business lenders take more risk than other commercial lenders, approving borrowers with credit scores as low as 500. But when you take more risk, the rate the borrower will see will be higher than they would see with conventional financing.

- Shorter Terms: because the bad credit business lenders take higher risk, the terms associated with the financing facility will be shorter than with a conventional loan.

- More Fees: alternative lenders charge fees that conventional lenders won’t charge. In fact, some bad credit business loans can have fees as high as 10%.

Do Alternative Lenders Work With all Credit Types?

They do. While many alternative lenders offer financing to businesses with bad credit, they also provide financing to business owners with fantastic credit. While most business owners would prefer a bank loan, sometimes the process is too cumbersome and time-consuming to complete. Knowing an alternative business lender with provide minimal paperwork and fast funding may be enough to get the borrower to move forward with the alternative loan.

How Does Bad Credit Affect Alternative Lenders Rates?

Make no mistake: just because there are lenders that provide financing to businesses with bad credit, that doesn’t mean the cost of borrowing will be cheap. Some alternative loans can have rates that aren’t much higher than a traditional lender would offer, but other have rates that are as expensive as it gets.

Types of Bad Credit Alternative Business Lenders:

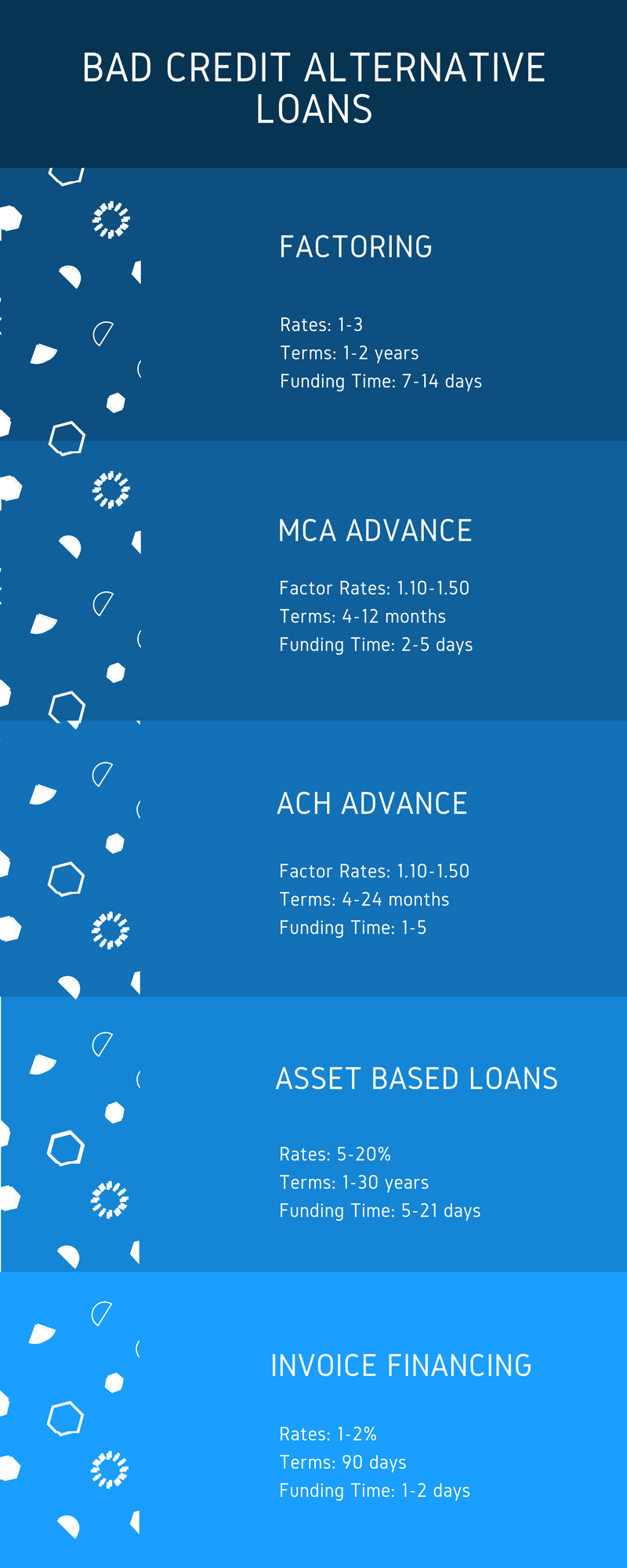

- Factoring: selling your invoices or account receivables is a great way for businesses with bad credit to get financing without having to pay the high rates of a cash advance. A factoring company may charge as little as less than 1% per month in factoring fees.

- Asset Based Lenders: using your company’s assets (such as real estate, equipment & machinery, A/R, or machinery) is another type of financing used by borrowers with bad credit. An asset based lender is willing to provide financing because they’ll have recourse, as the assets on the company’s balance sheet are used as collateral.

- Invoice Financing: selling your unpaid 30-90-day invoices is another way for business owners with poor credit to obtain affordable financing. A factoring company will purchase the invoice from the company, forward up to 95% of the invoice’s value, and keep a small fee for itself. When the invoice is paid, the remaining amount is forwarded to you.

- Merchant Cash Advance Split: this type of unsecured business financing is perfect for business owners with bad credit that also process a large amount of credit card transactions with their business. The advance funder will purchase future receivables from the merchant, and then collect repayment by splitting the credit card transactions with the business.

- ACH Cash Advance: this is very similar to a merchant cash advance split funding, with the only major difference being how the ACH advance is repaid. As opposed to splitting the merchant’s credit card transactions, the funding company will collect repayment by having a set amount taken from the merchant’s bank account each business day using Automated Clearing House.

- Equipment Leasing: while purchasing equipment and machinery outright may be appealing, some business owners with bad credit may opt to lease their equipment instead. With equipment leasing the leasing company will purchase the equipment for the small business and then lease the equipment to the business for a period of time.