Marijuana Business Funding

With the legalization of cannabis and marijuana products across the United States, so has the need for financing of cannabis business operations. Whether you are a marijuana or cannabis dispensary, a marijuana industry grower, cannabis product manufacturer, or weed industry distributor, there is a need for financing. In this article we will take a look at ways to fund your cannabis dispensary, farm facility or other operations related to the marijuana business.

We are in a revolutionary time filled with skeptics and misinformed nonbelievers – but this time is also fueled by the overwhelming population who demands access to legal medical and recreational marijuana. At higher rates than ever before, Gallup polls have shown that public support has grown for legalizing recreational marijuana to over 60 percent of the United States population; public support for the legalization of medical marijuana is at 89 percent, up from 74 percent in 2011.

At the beginning of the legal weed debate in the 1960s, a mere 12 percent of the American population supported access to legal marijuana; by the ‘70s, support grew to around 28 percent, but then quickly decreased as the “war on drugs” grew throughout the country. Then, in 2013, states like Colorado and Washington finally had the majority’s voice, and the farfetched idea of legal pot became a reality.

As success in the legal recreational and medical cannabis industry has helped Colorado, Washington, and Oregon flourish, other states have taken notice, leading to an overwhelming seven states legalizing either recreational pot or medicinal weed in the November 2016 election cycle. Year after year, states throughout the country are taking small steps to support one of the fastest growing industries in the United States, such as decriminalizing marijuana, even in non-legal states. With rapid legalization throughout the country, evidence to support medical and recreational use of cannabis has allowed many stigmas about weed to be dispelled.

As support from local and state governments grow, so does the vocal support from people everywhere who are no longer fearful of federal intervention, which has ultimately led to one of the fastest growing, bustling industries the United States has seen – particularly during a time where many other industries are experiencing stagnant or decreasing growth.

Medical and Recreational Marijuana Industry Analysis:

While growing public support for the legalization of both recreational and medicinal cannabis is important, what has really helped to shift the views of many state governments is the massive economic impact that legal weed has had on many states. In 2016 alone, legal recreational and medical cannabis states generated an economic impact of $16 billon to $18 billion – and it does not stop there. The United States legal marijuana industry is projected to have a 241 percent increase by 2021, which means creating an economic impact of $48 to $68 billion in just four years.

Basically, for every dollar spent by marijuana patients and/or customers just at the retail level¸ there is an additional $3.00 in economic benefit for the United States, much of which is circulated back into the local economy. This does not even include other related industries that are a part of the greater medical and recreational marijuana industry, such as growers, doctors, and so forth. This has helped many local economies thrive due to the effects of the legal marijuana industry. Jobs are created through this booming industry, which then generates profits to pay wages for those employees, who then spend some of their paychecks at local grocery stores, retail stores, and local restaurants. Then, all of these marijuana businesses pay endless amounts of money in state and local taxes – much of which is utilized to fund major state projects and even scholarships. In addition, these same businesses lead to benefits for the real estate and construction industry. All in all, the unrealized potential for economic benefits on a state level are almost unbelievable, but in the end, this will be one of the major selling points to convincing more states – and maybe even the federal government – to legalizing medical and recreational marijuana.

Booming business growth inherently comes with increased job generation. The Marijuana Business Factbook 2017 has shown that the United States cannabis industry is responsible for 165,000 to 230,000 full and part time workers, quickly surpassing employment rates in other business sectors such as dental hygienists and bakers – and the marijuana industry is quickly on track to surpass telemarketers and pharmacists. A report from New Frontier Data has even shown that by 2020, the legal cannabis sector is expected to create more than a quarter of a million jobs – which is more than manufacturing, utilities, or government job prospects for the future. These numbers are astounding, especially when considering the legal pot industry is a relatively new sector; but as demand for recreational and medical cannabis continues to increase, so will future job growth potential.

Cannabis Industry Trends:

There is so much happening in the marijuana industry today, but some of the top issues stem from a new administration that has elected a self-proclaimed anti-marijuana Attorney General. In particular, the ongoing legal issues associated with cannabidiol, otherwise known as CBD, has raised some concerns amongst many in the cannabis industry today. In contrast, the legal cannabis sector is also experiencing a unique phase of untapped potential and markets, especially when it comes to the medical marijuana industry. Some of the top trends and issues for the cannabis industry include:

- CBD Legality Issues: First, let’s discuss what CBD is. Cannabidiol is a naturally occurring chemical compound that is found in hemp plants that is cited for many amazing medical benefits and therapeutic properties, however, it lacks tetrahydrocannabinol, or THC, which is the component that gets people stoned. CBD is utilized to treat a variety of conditions, ranging from pain and anxiety to arthritis, diabetes, schizophrenia, PTSD, and other neurological disorders. However, there is a major misconception circulating amongst anti-marijuana supporters that claim that CBD may be acceptable for medical use, but THC is not. Ultimately, the debate around the legality of CBD extraction and utilization has stirred controversy with the federal government. By the end of 2016, the DEA sought to create stricter laws around the extraction and distribution around CBD products, ultimately fighting to continue to treat CBD has a Schedule I substance – which is the same ranking as drugs like heroin and LSD. Ironically, hydrocodone, cocaine, and methamphetamine are classified as Schedule II drugs. Either way, this ruling has continued to fuel the controversy associated with CBD production, but many legal marijuana business owners are feeling optimistic about the ongoing battle, even with a new anti-cannabis Attorney General.

- Overwhelmingly High Demand Shocks States: We all heard about Nevada’s “emergency situation” on July 1, 2017 when the state started legal adult use recreational marijuana sales. Demand was so unexpectedly high for recreational weed that Nevada’s Governor had to issue a statement of emergency regarding the regulations on distributors for dispensaries to combat rapid shortages. By the end of the week on July 7th, retailers paid $3,500 per pound of wholesale marijuana, which is more than the prices paid in all of 2016. Needless to say, people want legal pot. In addition to Nevada, Colorado experienced its best year yet for the cannabis industry – and then hit even higher record breaking numbers in the first two months of 2017, totaling over $235 million in profits, up 30 percent from record-breaking 2016. Hopefully, newly legalized states are taking note. California is already the sixth largest economy in the world, which has left many business owners gearing up for massive profits in the future through innovation.

- Untapped Health and Wellness Markets: Obviously, recreational marijuana is a massive industry, but the medical marijuana industry still has major untapped potential. In just a few short years, scientific researchers have discovered more than 40 health conditions that benefit from marijuana therapies – but the cannabinoid-based pharmaceutical market is still in the early phases. The medical marijuana market is currently exceeding $50 billion annually, however there are still many obstacles to overcome with the federal government. As regulations continue to change and relax, the medical marijuana industry is poised for exponential growth soon.

Cannabis Business and Dispensary Loans:

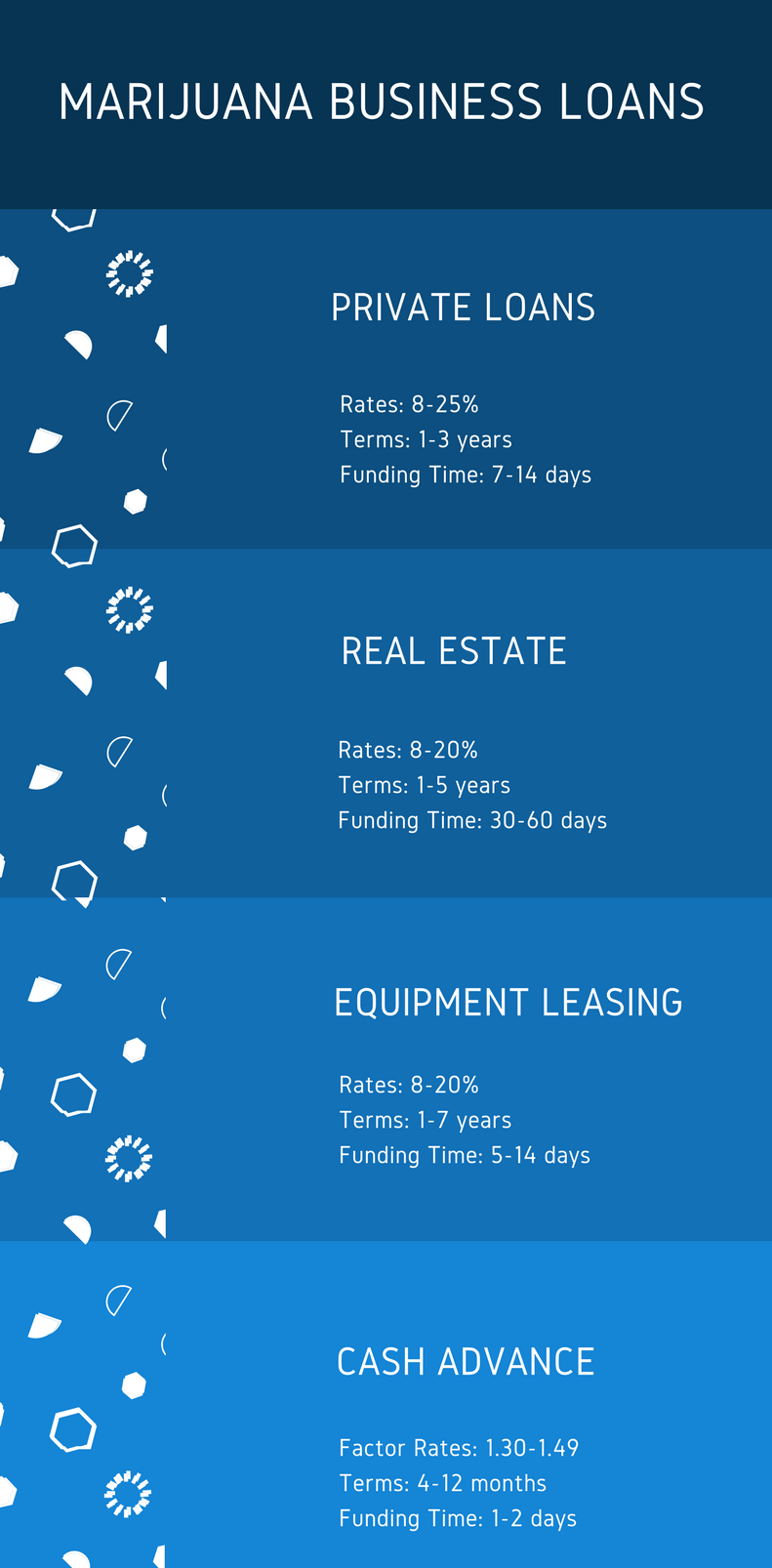

- Private Loans: This is probably the most common type of financing for marijuana businesses and cannabis companies. Private non-bank lenders generally like to lend to growers and manufacturers of cannabis products (like concentrates, vapes, marijuana edibles and cannabis gear). Most private lenders try to shy away from funding pot dispensaries, but some will provide financing if the dispensary has good revenue.

- Equipment Leasing: Another type of cannabis industry financing that is almost solely focused on growers in need of agriculture equipment to help with growing cannabis. By using an equipment leasing company to acquire the marijuana agriculture machinery for their grow operations, cannabis company can get crucial equipment to make sure their grows flourish.

- Commercial Real Estate: Commercial real estate lenders are willing to provide financing to successful growers seeking to purchase land or real estate to help with their grow. Type of commercial real estate loans available to medical marijuana businesses and cannabis companies include bridge loans, hard money loans, and shorter-term mortgages.

- Dispensary Cash Advance: While not a loan, this type of short-term cannabis financing is the perfect way for to obtain fast short-term marijuana dispensary inventory funding. But to get a weed dispensary cash advance your pot dispensary needs to have strong bank statement revenue.

Marijuana Industry Investing

If you’re not yet in the marijuana or industry but looking for ways to invest in the cannabis industry, there are a number of investment opportunities. There are a growing number of cannabis company’s seeking investors to help to quickly-scale their operations and aggressively seek to gain market share. If you are an investor looking to invest between $100,000 and $10 million, we have cannabis company seeking your investment.

If you are interested in investing in the cannabis industry or looking for a medical marijuana or dispensary loan, please reach-out to our commercial funding specialists, and they’ll help you navigate the process.