Short Term Franchise Funding

In the United States today, people everywhere are fed up with the regular corporate business system that many of us have grown up with. Now, Americans are taking matters into their own hands, which has led to the massive startup and entrepreneurial culture that is dominating the United States. People everywhere are fascinated with being their own boss and making a profit outside of the rigid corporate system. Today, potential business owners have three main options for running their own business: starting an independent business, entering into a business opportunity, or becoming a part of a franchise business opportunity.

Obviously, starting an independent business on your own is a pretty straight forward concept revolving around an innovative idea and some financial backing, whether that is through personal funds or through traditional bank loans and alternative financing options. Alternatively, some entrepreneurs consider the business opportunity route which consists of two distinct business types.

A business opportunity, otherwise referred to as a “Biz Opp”, is a unique opportunity that allows the entrepreneur to start their own business, not independently. Essentially, a business opportunity involves a seller of a brand or specific product with a pre-packaged set up that they then sell to the buyer. For example, vending machine companies are known for this style of business ownership. A vending business allows the entrepreneur to utilize and distribute their products (with a vending machine) in a quality location that sees a lot of foot traffic. Typically, there is an agreed upon split of revenue between the owner of the vending machine and the owner of the location. While this set up is similar to a franchise, there are obvious differences. The biggest difference between a business opportunity of this nature and a franchise business opportunity is the lack of oversight from the seller. Where franchise owners have strict rules and legal requirements to protect the integrity of the brand, Biz Opp business owners do not require as much oversight and fees.

The other type of business opportunity, referred to as a franchise, is often the more favorable route for many entrepreneurs. Basically, a franchise is defined as a business with a franchisor (the franchise owner) that has an existing product or service (an established business). Then, the franchisor creates a contractual agreement with a franchisee, or the entrepreneur that wants to start their own business. While this business model has similarities to both independently owned businesses and business opportunities, it differs in many ways. For starters, franchisors, through the contractual agreement, require the franchisee to follow certain guidelines to maintain a reputable brand name. This can include a predetermined and agreed upon location for business, certain marketing strategies, how the brand can be utilized, product and price offerings, and so forth. Also, a franchisor usually requires the franchisee to pay a fee and regular royalties to the franchisor for these business rights. Essentially, a franchisor provides a franchisee with a business blueprint in order to maintain the integrity and success of the franchise name.

Franchise Business Industry Analysis:

Economy-wide, franchise businesses have outpaced other United States businesses year after year since 2013 – and this is across a variety of sectors that franchise businesses dominate. According to an annual report, The Franchise Business Outlook 2017, by the International Franchise Association, franchises are the top market for aspiring business owners, while remaining one of the largest job generators throughout the United States. In 2016 alone, there was a a growth of 1.6 percent, with a forecasted growth of 2.3 percent in 2017 – this is mainly in part to franchise owners becoming optimistic at the business climate after the most recent election. Many franchise business owners are expecting the Trump administration to roll back on strict Obama-era regulations, particularly the Affordable Care Act, minimum wage hikes, and tax regulations.

In addition to overall growth, the franchise sector grew at a faster rate year after year in regards to gross domestic product (GDP) than the overall United States GDP. In 2017, the franchise sector’s GDP is expected to rise 5.6 percent to $552 billion, which means that the franchise industry alone will generate $29 billion in GDP to the United States economy. Not only will the country’s GDP benefit, but so will the unemployment rates in the United States. Over the past five years alone, the franchise business sector has created almost 1 million jobs to the economy, outpacing the average annual job growth in the United States by 2.6 percent. In 2017, franchise businesses are forecasted to generate a 3.1 percent increase in jobs, adding 278,000 employment opportunities to the United States.

Overall, many entrepreneurs are reaping the rewards and benefits of franchises today. Here are some of the top franchises by establishment growth for 2017:

- Personal Services – 2.3 percent

- Quick Service Restaurants – 1.9 percent

- Table and Full Service Restaurants – 1.9 percent

- Retail Products and Services – 1.7 percent

- Business Services – 1.5 percent

The Joint Employer Standard:

While there are many advantages, disadvantages, and revolving trends to owning and operating a franchise business, there is one issue in particular that has left many franchise business owners worried – the National Labor Relations Board’s (NLRB) August 2015 ruling about new joint employer standards for union membership and franchise employment. This regulation is rather complicated and convoluted, but mainly because the employer-employee structure of a franchise business model is confusing.

In a typical independently owned business, the business owner is the employer who is responsible for the people he or she hires. Every manager and employee is paid and managed by the business owner. So when there are discrepancies between business owners and their employees, such as anything that does not follow state wage, hour, and antidiscrimination law requirements, employees are able to sue their employer directly. Well, with a franchise, this system gets a little more complicated. When an employee is being illegally underpaid, is it the franchisor or franchisee’s fault? Who is responsible for the discrepancies? For years, it was the franchisee, or the owner of that individual franchise business, not the overall franchise owner. After many legal battles, the Obama administration updated the legal interpretation of the definition of a joint employer, while broadening the definition under collective bargaining law. Now, because franchisors do exert some form of control over the franchisee’s individual owners, they are considered joint-employers that will both be accountable in these unique cases.

Obviously, many franchise owners were not excited about this interpretation of the law, and many franchisors are optimistic about the future of this interpretation due to the new administration, particularly because the Trump administration has already articulated their desire to reverse this ruling. However, many franchise business owners are still waiting for results, which are expected to be awhile in the making as the ongoing healthcare battle continues.

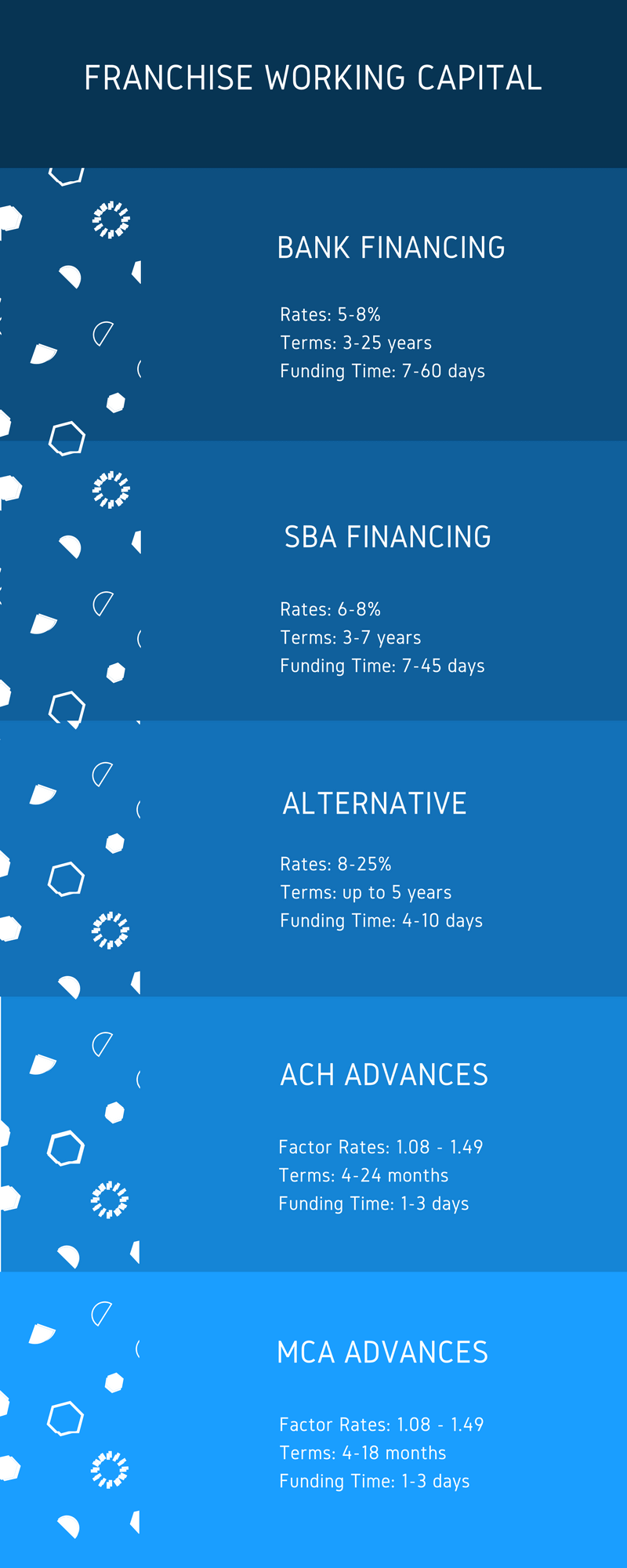

Types of Franchise Working Capital Loans

- Bank Franchise Working Capital: This is the ideal franchise working capital option for companies with good credit and profitability who need short-term working capital to help with their business operations including: making payroll, purchasing equipment, helping with a marketing or advertising effort and other needs. Bank working capital is always the preferred choice for financing because the rates and term associated are the best available. Banks are able to offer franchise working capital options as both term loans, or secured and unsecured lines of credit.

- SBA Franchise Working Capital: SBA working capital for franchises is another fantastic financing option for a growing business because the rates and terms are inline with what you’d see from a conventional lender, and that’s because SBA franchise lenders are conventional lenders like large and small banks, credit unions and non-profit community lenders. The difference between a bank franchise working capital loan and a SBA franchise working capital loan is the fact that SBA loans are provided a SBA enhancement that helps protect the lender by covering most of their losses should the franchise fail to repay their SBA loan. SBA working capital loans are great for long-term working capital and short term uses, and come as both term loans ranging up to years, or lines of credit.

- Alternative Franchise Working Capital Loans: While many franchises and franchise owners may have good credit and decent cash-flow, it may not be enough for them to get a working capital loan from a traditional lending institution. For franchises who need affordable working capital there are alternative options from online fintech lenders, marketplace lenders, and non-bank private lenders. While these options may not have rates as low as you’d see from a bank, the rates are still very affordable and the terms can range up to 5 years. Additionally, an alternative working capital loan for franchises require much less paperwork than a bank requires, and can fund within a fraction of the time.

- Franchise ACH Cash Advances: This is becoming a more common form of franchise financing in recent years, because it can provide a franchise with working capital almost immediately without much paperwork at all. Franchise ACH merchant cash advances are the sale of the franchise’s future bank account receivables to a factoring company or cash advance funder in exchange for immediate cash financing. Rather than the franchise waiting around for weeks or months to get paid, a franchise can tap into their future sales and get paid up to 18 months early. The reason its referred to as an ACH cash advance, is because the funding amount is repaid to the lender by having a set amount sent to the lender from the franchise’s bank account using Automated Clearing House each business day.

- Franchise Credit Card MCA Advances: This type of funding is a variation of the ACH cash advance, in that they both aren’t loans, but are sales of future receivables. The difference between an ACH loan and a MCA credit card advance is the way they are paid back. Whereas a ACH cash advance is repaid by having a set amount sent from the franchise’s bank account each business day, a MCA credit card split is repaid by splitting the franchise’s credit card sales with the funding company. Instead of a set amount being remitted to the funding company, the funder will simply take a percentage of each day’s credit card processing sales from the merchant account until they are fully-repaid.

Conclusion

There are quite a few options for franchises looking for help with short-term funding and operating capital. With so many options its key that you shop around for the best eaters and terms so that you’re not putting a cash-flow crunch on your franchise. If you own a franchise, and are in need of immediate working capital and need help understanding your options, please reach-out to one of our commercial franchise loan specialists, and we’ll help you navigate the funding process.