Physical Therapy Practice Funding

For a few years now, physical therapy, or PT, has become one of the most attractive sectors in the healthcare industry. For many people, physical therapy has become vital for living a pain-free, healthy lifestyle without the ridiculously high medical costs that are typically associated with other forms of care and treatment. Usually, patients will have an injury or some type of pain that they are concerned with, so they go see their primary care physician. While this was not always the case in the past, today, primary care doctors have started to integrate physical therapists into their patient’s care team, especially if they are dealing with chronic pain from a specific injury, un-diagnosable chronic pain, if they are considering surgery for an injury, or if they are simply getting older and need help maintaining vital body functions like balance.

Overall, physical therapy is revolutionizing the way the healthcare system works by applying these important physical therapy techniques into the daily lives of many patients. Some of the top reasons physical therapy is on the rise for its game changing tactics include:

- Reducing and/or Eliminating Pain: Physical therapists are paving the way with innovative exercises and techniques, such as joint and soft tissue mobilization and treatment, to help patients with various ailments deal with daily chronic pain. Physical therapists everywhere have expressed the need for patients to focus more on physical therapy than opioid use when it comes to chronic pain issues.

- Avoiding Surgery: Many people throughout the healthcare system have been aware of how beneficial physical therapy sessions can be in avoiding invasive surgeries to repair injuries. While not every patient is able to avoid surgery through physical therapy, strong results have shown the benefits of those patients incorporating physical therapy exercises into their daily lives before surgery in order to see better and faster results from the surgery. Also, physical therapy is cheaper than surgery!

- Recovering from a Stroke and Mobility Issues: Having mobility issues after a stroke is incredibly common – even having mobility issues without a stroke is an issue that plagues many people. Either way, the key to effectively regaining at least partial function is through physical therapy treatments. Also, this has become an effective way for many older patients to deal with natural mobility and balance issues.

Physical Therapy Industry Analysis:

Today, the physical therapy industry market is a $30 billion industry. In addition, the industry is expected to see an average 5-7 percent growth rate in the next year. Surprisingly, even though the physical therapy industry is generating plenty of money, the physical therapy sector is highly fragmented; this means that no company controls a significant market share. However, this fragmentation is starting to shift as many prominent physical therapist business owners are realizing the potential to consolidate. This led to 2016 being filled with mergers and acquisitions from many physical therapy companies, but there will remain a market for many small local physical therapy businesses. The rapidly increasing graduation rates of people in the physical therapy field have led to many small physical therapy establishments opening up and thriving, mainly due to high demand for quality, effective physical therapy professionals. There is currently a 34 percent expected job increase in the physical therapy sector, which is much faster than the 7 percent national average for every other industry throughout the United States.

Physical Therapy Sector Trends:

Obviously, the physical therapy business sector is thriving today, and it is only expected to continue to grow. As the physical therapy industry blossoms, many trends are emerging that will differentiate the top physical therapists from the rest. Some of the top trends, particularly in relation to technology, include:

- Aging Baby Boomer Population: The reality is, people are getting older – about 5 percent, or 46.2 million, of the United States population in 2014 was over 65 years old. This population is expected to live longer than any other generation so far. So, with the United States Medicare and Medicaid programs covering an average of $18,424 per person aged 65 and older, it is incredibly unrealistic to believe that this is a sustainable way to treat our aging population. This is where the physical therapy sector has thrived. By focusing on working with primary care physicians at the beginning of an older person’s care, these physical therapists have helped lower the overall costs of healthcare, while allowing these people to implement more effective and long-term strategies for their health.

- Physical Therapy Combatting the Opioid Epidemic: Unfortunately, the entire world is blatantly aware of the drug epidemic, especially when it comes to prescription opioid abuse. The Centers for Disease Control has shown that sales of prescription opioids have quadrupled in the United States alone, and the high addiction and overdose rates match. Thus, many physical therapy practices have made huge efforts to advertise and educate about the benefits of physical therapy in regards to avoiding opioid prescriptions in the first place. Ultimately, physical therapists are working hard to push the message that opioids do not fix chronic pain, but physical therapy does.

- Avoidable 30-Day Hospital Readmissions: Today, physical therapists are enjoying being a part of a patient’s long-term care team, but this was not always the case. For years, physical therapists were put on the back burner for later use when the primary doctor was done with surgery or other methods. Now, hospitals are struggling with frequent readmission rates, but studies have shown just how beneficial physical therapists can be in combating these alarming readmission rates. Through personalized care, effective physical therapy techniques, and successful implementation of these routines into patient’s daily lives, many patients are no longer contributing to the avoidable 30-day hospital readmission rates.

- Physical Therapy, Technology, and… Gaming?: The biggest battle that physical therapists are facing today is convincing their unmotivated patients to continue with physical therapy, because results to not simply appear overnight. Now, physical therapists have started implementing a few techniques that have been proven to not only help patients with multiple different issues, such as Parkinson’s and burn victims, but also help to engage the patient to continue their care – Wii-Hab. Yup, that’s right! Wii-Hab has become an incredibly beneficial tool that incorporates gaming on consoles like Wii’s and the Kinect for Xbox 360’s; and people of all ages are enjoying these practices that have been incorporated with other physical therapy techniques.

Types of Physical Therapy Business Loans:

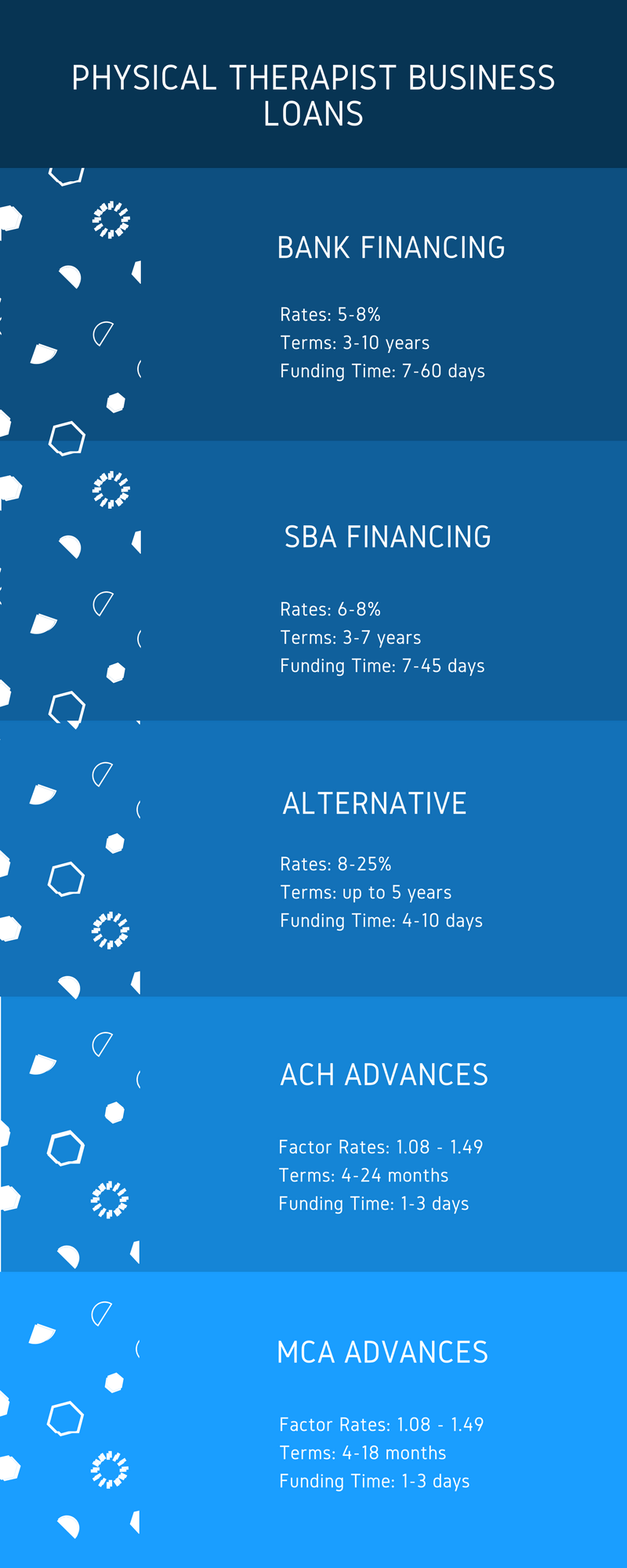

- Physical Therapist Bank Loans: While this type of business financing isn’t exactly easy to obtain, if your physical therapy practice has good credit and revenues, true bank-rate financing is the best option available for any small business. Bank loans are used for a variety of purposes and has the best rates and the longest terms – which is important for any growing business. Bank financing comes in both term loans and lines of credit, and can be obtained on both a secured and unsecured basis. Common uses of a bank loan include: purchase and/or refinance of commercial real estate, working capital, equipment purchases, build-outs and expansion.

- Physical Therapy SBA Loans: Another bank-rate financing option available to physical therapy practices and all small businesses who have been unable to obtain a bank loan previously. SBA financing for physical therapist offices are actually loan provided by small and large banks, credit unions and community lenders who utilize the SBA’s loan enhancement program. Using this program, a SBA lender has a large percentage of the loan to the physical therapist backstopped by the Small Business Administration – which reduces the lender’s risk. By reducing this risk, the lender is more likely to lend to the physical therapy practice. Common uses of SBA loans are acquisitions, real estate purchases and mortgage refinancing, debt refinancing and consolidation, and general operating capital purposes.

- Alternative Physical Therapy Business Loans: Generally any non-bank or private business loan offered by online lenders, fintech lenders and marketplace lenders are considered alternative business loans. Non-traditional business financing options are numerous, with many different characteristics, but the most common are the rates and terms: which sit in the space between bank loans and high-interest merchant cash advances. Mid-prime alternative loans are the perfect option for a physical therapy practice with good credit that has been unable to get approved for a bank or SBA loan. Midprime alternative loans are most commonly used for working capital, expansion, advertising and marketing purposes, and other short term financing uses.

- Merchant Cash Advances: While a cash advance is an extremely easy type of financing to obtain, the ease of funding comes with a price, as merchant cash advances are the highest rate financing options available to small businesses. While not loans, a merchant cash advance is the sale of your physical therapy’s future bank account or credit card receivables to a funding party who will purchase the receivables at a discount.

Conclusion

With so many funding options available to physical therapy practices, some business owners may find the process of finding the right loan a daunting task. If you have a physical therapy practice and looking for financing, and could use help with obtaining the right business loan, please reach-out to one of our business funding specialists, and we’ll help you navigate the process.