Long Term Business Funding:

Getting funding for your business is a daunting task – especially with so many options available. When companies search online for different types of financing, they may find dozens if not hundreds of funding options that look dramatically different than each other. Some are shorter in term, some are longer, some are higher-rate, others are low-rate. While many borrowers focus almost solely on the rates associated with a loan, its important that the term and amortization length aren’t overlooked, as they’ll play a key role in how much a business pays each month in debt payments. In this article, we will take a look at the long-term business financing options and how to obtain one.

Why is Long-term Financing Difficult to Obtain?

The main reason is that longer-term financing poses an increased risk to the lender. Fact is: the longer the loan takes to pay back, the greater the risk that the business fails to make it to the terms end. For instance, obtaining a loan for more than 5 years for working capital is extremely difficult, especially if the loan is unsecured or if the business lacks substantial assets. Now, if a company has commercial real estate that will be used to secure the financing, that will help reduce the lender’s risk exposure, and may therefore provide a longer-term facility. But if the company is asset-lite, the chances of seeing a long-term loan is slim. If the company is experiencing low cash-flow, or are having trouble making existing payments to creditors, the terms they’ll see offered by a lender or funder will decrease in size. So, the best chance of seeing a long-term business loan is to have substantial assets and great cash-flow.

What are the Benefits of Long-Term Business Loans:

- Lower payments: The main reason a long-term loan is beneficial to a small business is the reduced strain with servicing the debt. For instance, if a company is making monthly payments on a $100,000 loan, the amount they’ll pay each month to the lender in repayments would be much less if the loan is amortized over 10 years, than if it were only amortized over as 5 years. That shorter-term loan may have payments that put way too much strain on the company’s cash-flow to be sustainable.

- Lower rates: The simple fact that a business is approved for a longer-term business loan usually means that they will also qualify to exceptional rates. Therefore, long terms and low rates go together.

Drawbacks of a Long-Term Loan:

- Interest: There aren’t many cons associated with a long-term business loan. About the only one that should be considered is that you will be paying interest on the loan over a longer period of time. But, that must also be balanced against the fact that longer-term business loans tend of have lower rates than shorter term, higher-risk business loans and advances. So while a company may be paying interest on a loan for a longer time than with other financing types, the rates may be well lower than they would with an alternative lending option.

- Collateral: As mentioned, a long term business lender exposes themselves to considerable risk. The facts show that the average company doesn’t stay in business for 10 years, let alone 20. To ensure the lender is paid-back (or, if not, to make sure they have ways to reduce their losses) a lender will usually ask for some sort of collateral.

- Credit: Its hard enough to get short term business capital with great credit – getting a long-term business loan almost requires impeccable credit. Business owners seeking long term capital will need to have credit scores of at least 650, and may need to have scores over 700 to get approved.

Long-term Business Loan Uses:

- Business Acquisitions: Its rare that a business owner would seek short-term financing to purchase a business. Most, if not almost all, business acquisitions are handled using some sort of long term financing, whether it be traditional or alternative. Most common forms of financing for business acquisitions are conventional bank business loans (offered by traditional lenders like large and small banks, credit unions, community lenders and non-profit business lenders, SBA lenders) but are also offered by some non-bank lenders and private business lenders.

- Commercial Real Estate Purchase: If you’re a business looking to purchase your commercial real estate, you generally want to get terms and amortization schedules that are as long as possible, as you wouldn’t want to absorb the total cost of financing over a very short period of time. Therefore, most commercial real estate purchases have terms that range between 5-30 years (depending upon lender). That doesn’t mean there aren’t short-term options to purchase your commercial real estate, but those types of loans are usually used to bridge to a longer-term financing facility or commercial mortgage.

- Commercial Real Estate Refinance: Once a company acquires commercial real estate to use for business or investment purposes, it is common to begin the process to find a longer-term facility to help reduce the strain of debt payments. Fact is, by extending the term of the mortgage or loan, you will reduce the monthly payments associated with the payback. By reducing those payment amounts, it helps a business with cash-flow that can be used elsewhere with business operations.

- Construction Loans and Build-out: Not every business has free cash-flow that enables them to construct new facilities or build-out current buildings. For those that seek financing to help with the expansion of their business facilities, they will seek the longest-term business loan or mortgage because while they spend money constructing the buildings, they won’t be bringing-in additional revenue until after the project is completed. Therefore, getting the longest-term possible is crucial towards making sure the expansion is worth it.

- Long-Term Working Capital: Just about every company needs some sort of capital infusion at some point. The key is finding the most cost-effective capital, so that you aren’t stuck using crucial profits to repay the cost of borrowing money. Therefore, for many companies, getting the longest-term working capital is necessary to maximize their financial situations.

- Long-Term Equipment Purchases and Leases: Obtaining useful and up-to-date equipment and machinery may be important to make sure your company is competitive and offering the top services available. Oftentimes, upgrading your company’s equipment can help reduce costs over time and increase efficiency. But the cost of the equipment won’t be worth if if you are spending more in debt payments to obtain the machinery than you are receiving in profits. Getting a long-term equipment loan or lease is essential to make sure you maximize the benefits.

Types of Long Term Business Loans:

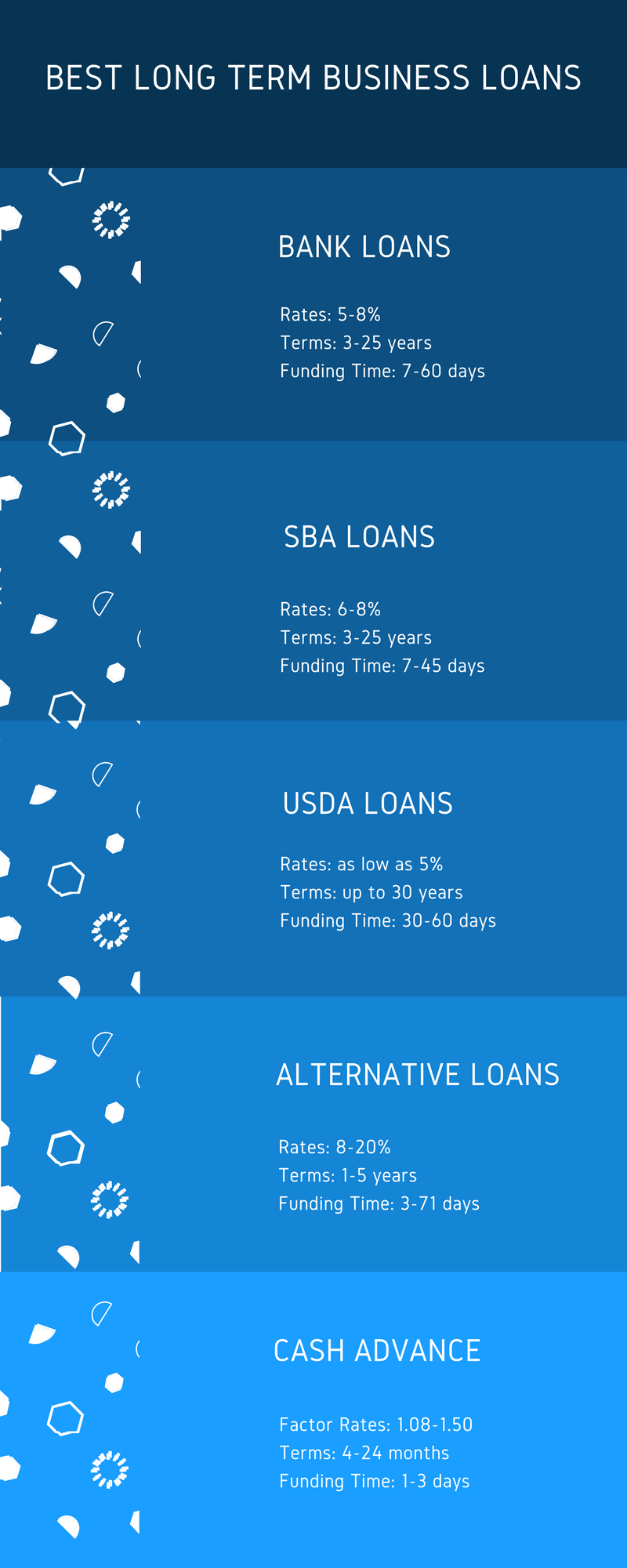

- Long-Term Bank Loans: Financing offered by the banks ends up not only being the cheapest form of business funding, but conventional bank lenders offer the longest terms and amortizations of all small business lenders. Banks offer long-term financing for real estate, construction, build-outs, working capital, expansion and just about any conventional financing use.

- Long-Term SBA Loans: Conventional financing backstopped by the Small Business Administration is another form of long-term funding that offers businesses with bank-rate facilities to companies that wouldn’t have received financing without the SBA-enhancement. SBA loans are used for business acquisitions, commercial real estate purchases, refinancing balloon mortgages, consolidating business debt and general working capital purposes.

- Long-Term Lines of Credit: One of the most sought-after types of business financing that comes in the form of pre-approved funding that a business can tap into without having to seek additional approvals from a lender. Long-term lines of credit are offered by conventional lenders, SBA lenders and asset based lenders.

- Long-Term Alternative Loans: loans provided by private lenders, non-bank alternative lenders, fintech business lenders and marketplace commercial lenders are a decent form of financing for companies seeking working capital and other operating capital purposes up to 5 years. While the rates are higher than those offered by banks, and while the terms cap-out at 5 years, these are quality funding facilities for working capital and expansion.

- Long-Term Merchant Cash Advances: While technically not loans, a business cash advance is a type of short term business financing. But just because a merchant cash advance is shorter-term than a bank loan, that doesn’t mean there aren’t longer term business cash advance options available to small businesses seeking immediate funding or financing for companies with bad credit. Most long-term merchant cash advances have terms between 12-24 months, and many have paybacks that are done weekly or even monthly.

Summation

As you can see there are plenty of options available to small businesses seeking long-term business funding. By obtaining the longest term possible, you will set your company up for the best chance at success because you will be spending less each month on debt payments, and the extra money saved can be put back into the business to help with growth. If you are a small business owner seeking a long-term business loan and need help with obtaining the longest possible term available, please reach-out to one of our financing specialists, and we’ll help you navigate the process.