Small Business Financing Without Collateral

Just about all small business owners will seek some sort of financing to start or grow their business at some point in time. Often, the common roadblock a business owner will face when attempting to get financed from their local bank as a collateral requirement. Its common for a business lender to want a business owner to pledge collateral that is, at least, equal in value to the loan they are seeking (in fact, many lenders will require the collateral pledge to be worth much more than the loan amount being sought). When a business owner needs to get funded, but doesn’t have collateral required by conventional lenders, an option may be to seek no-collateral business financing. In this article, we will discuss unsecured business funding and the options available.

Reasons Lenders Want Collateral

The main reason a lender will require collateral is to reduce the risk they pose to themselves and their investors. By providing collateral, the lenders will have a way to recoup some of their losses should the borrower default on the loan. Most conventional lenders will require collateral, and by having a collateral requirement, they reduce their risk, which is then passed-on to other borrowers. It is because of this lack of risk taking that conventional lenders are able to offer such low-rates. Conversely, because no collateral business lenders are taking lots of risk the rates they offer will reflect that risk (meaning: unsecured business lenders usually have rates that are higher than traditional lending institutions).

Types of Collateral Usually Required:

The types of collateral required by conventional lenders will very depending upon type of lending institutions. Most conventional banks and traditional lenders like to use personal and/or commercial real estate as collateral for financing, while other banks will accept those and also use the company’s inventory, equipment and machinery as collateral. Asset based lenders may use real estate, equipment and machinery as collateral for financing, but are also likely to focus on the company’s accounts receivable as collateral.

How No Collateral Loans Work:

Not all no collateral loans work the same. In a sense, the most common type of no collateral business financing comes in the form of business credit cards. But when it comes to true business loans and advances, there are three main ways to qualify for a no collateral business loan:

- Have good credit: The primary way to get a no collateral business loan with an affordable rate and favorable terms is to have outstanding credit. Since credit is a reflection of your past payments to creditors, having an exceptional credit score will let a lender know that you are very likely to repay the loan.

- Have good cash-flow: At the end of the day, a lender only cares about one thing: getting paid-back. While credit is a very important factor in getting approved for an unsecured business loan, being able to show sufficient cash-flow to repay the loan is equally as important, if not more important.

- Don’t have any existing business loans: In order to get a no collateral business loan a company must be debt-free. If you have a business loan, an unsecured business lender isn’t going to want to provide financing and put themselves in a position where they’d be unable to collect should the borrower default. Therefore, a small business must not have any existing loans in order to get unsecured business funding.

How is a No Collateral Business Loan Secured?

While a small business will not be required to pledge collateral to get approved for the loan, they may have a general lien placed on all business assets at funding. The purpose of using a UCC-1 lien is to let other perspective creditors know that you have first rights to the business assets should they default on the loan. With that having been said, many lenders won’t file a UCC unless the borrower enters default. So, while the business loan may be secured with all the business assets, specific assets of specific values aren’t required before getting funded with a small because loan without collateral.

Uses of No Collateral Business Loans:

- Expansion: Just about every business has the goal of expanding their operations and possibly open up more locations, hire employees, and grow revenue. But oftentimes such endeavors require a capital injection into the company to help pay for such efforts. Getting unsecured expansion capital is one way to help cover the costs.

- Advertising and marketing: There is a cost associated with getting your product or service advertised to the masses to help grow your customer base. If you’re a small business in need of funding an advertising budget, a good way to get financed is to seek unsecured marketing loans.

- Hiring employees: You may find your business incredibly busy and unable to keep up with the pace of growth which leads you to look to expand how many employees your company has. But the initial labor costs associated with hiring and training your employees come with a cost. A good way to take care of these new labor costs is to get a no collateral loan to hire employees.

- Emergency bills: There is always some unexpected issue that arises during normal business activities. The key thing is: these unexpected issues usually come with a price. When these problems arise, most businesses don’t have time to go through the approval process required by a conventional lender who’ll require collateral. A good option would be an unsecured emergency business loan.

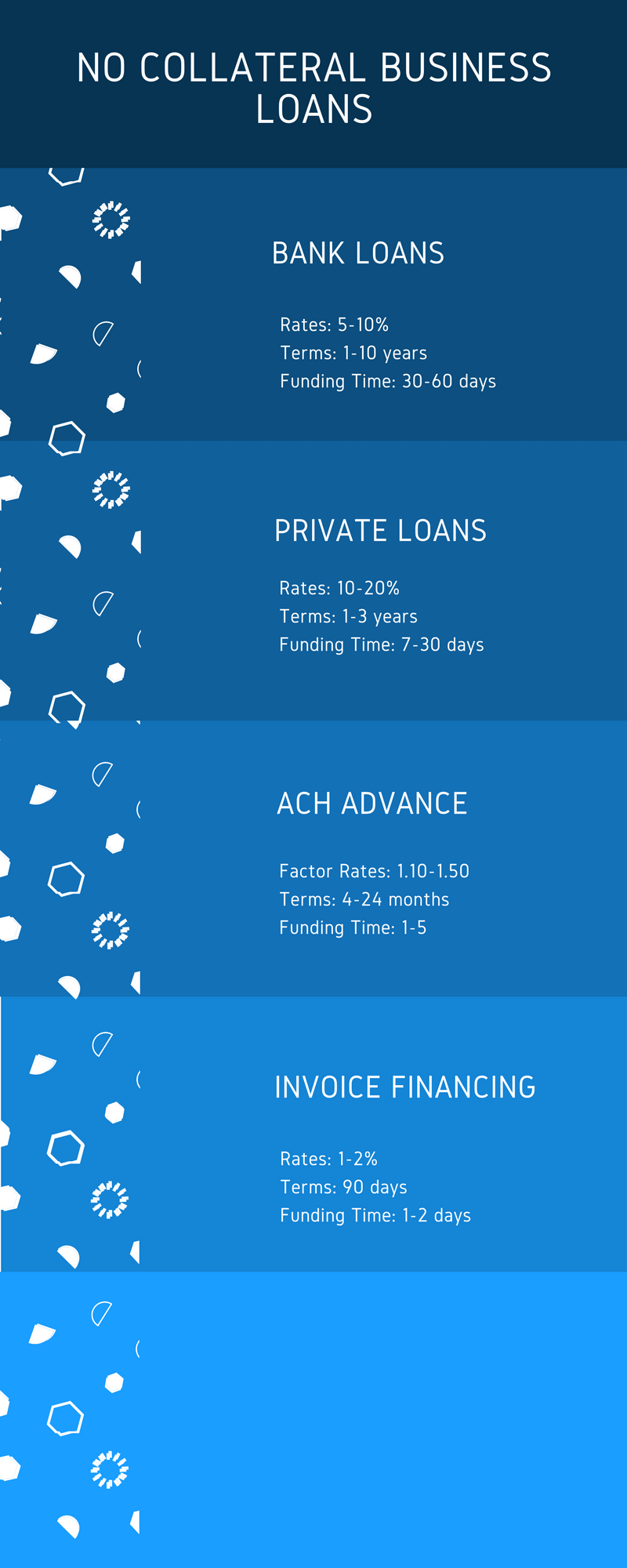

Types of No Collateral Business Loans:

- Unsecured Bank Loans: This is not an easy form of financing to get, but if you can obtain an unsecured small business loan from a bank, you’ll be obtaining the very best rates and terms of any type of business financing. No collateral bank loans are rare, and require exceptional credit, along with strong past financials. The process takes a long time, ranging from 30-60 days and you’ll have to supply lots of documentation, but its well worth the hassles because of the money you’ll save as compared to other funding options.

- Unsecured Private Lenders: Once again, these lenders won’t require you to pledge your personal or business assets as collateral to get funded, but that doesn’t mean your personal and business assets won’t be at risk should you default on your loan. In fact, a general lien will be placed on business or personal assets should you default. With that having said, the process of getting funded by a non-bank lenders, marketplace lender, or fintech business lender is much easier than getting funded by a conventional bank. Rather than needing to supply 3 years of tax returns along with 3 years of financial documents that a bank requires, an alternative lender may require as few documents as an application, one year financials, and two years tax returns. Once the documents are submitted to the no collateral alternative business lender, the loan is usually funded within a week.

- Invoice Factoring: This kind of business financing isn’t a loan, but the sale of a company’s unpaid 30-90 day invoices. A factoring company will purchase the invoices from the business, forward the small business a portion of the money, charge a fee, and forward the remainder of the invoice’s value once the invoice is paid.

- Merchant Cash Advance: Another type of business financing that technically isn’t a loan, a merchant cash advance is the sale of a company’s future receivables to a merchant cash advance funding company in order to obtain immediate funding to receivables they’ll receive over the next 18 months. After the merchant is funded with the no collateral merchant cash advance, the funding company will then collect repayment by taking a set amount directly from the merchant’s bank account each business day, or by splitting a portion of the merchant’s daily credit card sales.

Conclusion

Its not easy to find and get approved for a no-collateral small business loan on your own. While the number of lenders willing to offer unsecured business funding are few in numbers, if you are able to find lenders who do offer no-collateral business loans, they may not offer the right type of financing your business needs. If you’re interested in seeking a no-collateral business loan and need help understanding your options, please reach-out to one of our funding specialists, and they’ll help you navigate the process.